M.职业price action技术裸k交易者的交易思路!!!!

发表于:2014-08-15 13:51只看该作者

103楼 电梯直达

103楼 电梯直达韬客社区www.talkfx.co

104楼

本帖最后由 mantisli 于 2014-8-15 22:15 编辑

说明一二:

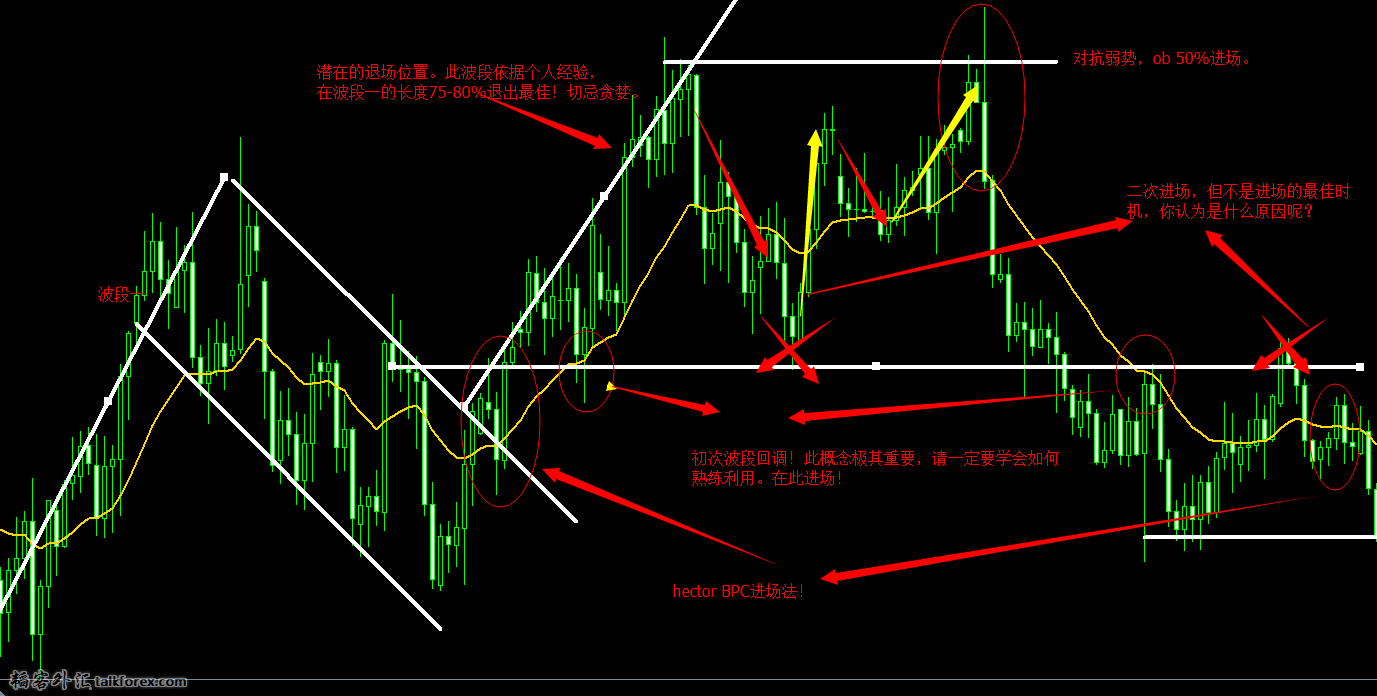

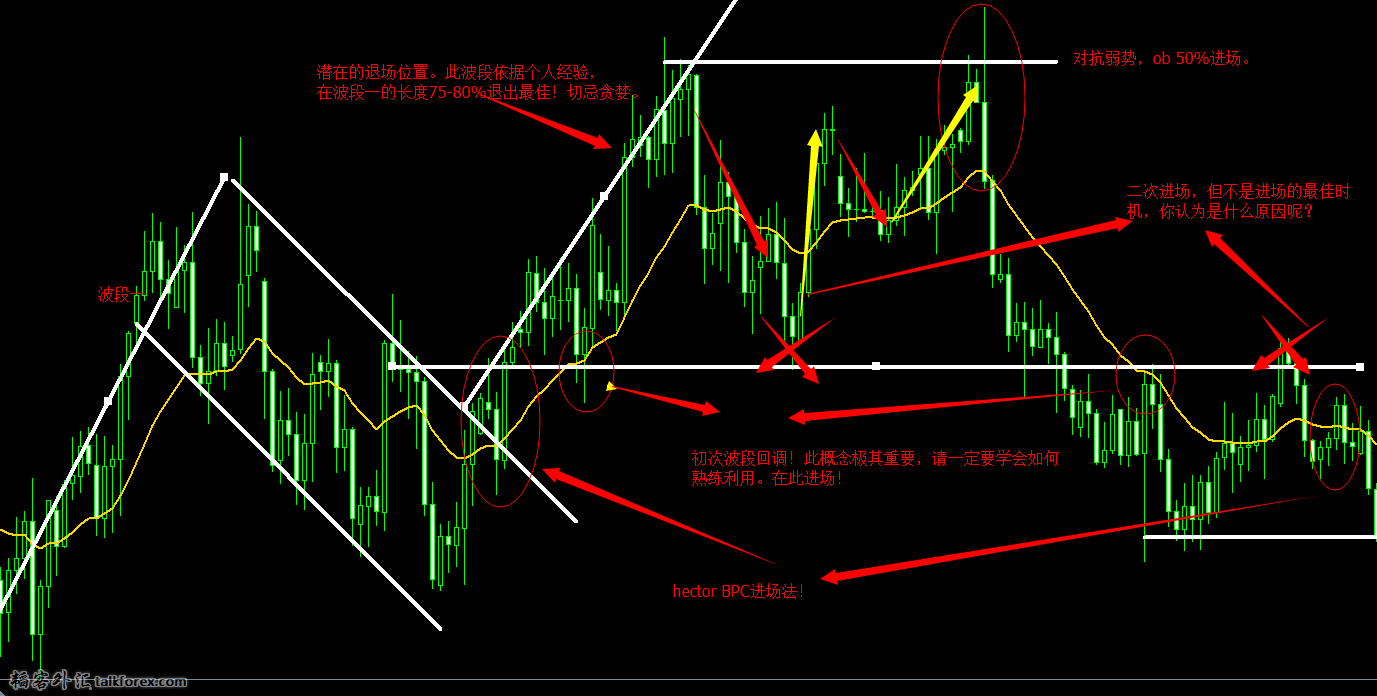

关于楼上说的前后矛盾问题。因为我的进场方法不止一种。一种是bar pattern entry ,例如,pb,ib,ob等直接进场的就属于这种,另外一种是chart pattern entry,这种方法是本人交易系统的核心内容之一,所以目前我没有截图说明,我说过我的博客,以及帖子内容是由浅入深的分享。还有退场方法也是很重要的一方面,博客以后会提及到。

楼上的某位说 我是事后分析,还真不是,我的截图都是真实 的交易单。没有实盘分析,因为涉及到6条规则,陷阱交易等核心内容。暂时保留着部分内容。

关于,那位朋友说我无故贬低nail fuller这人,本人有pa交易资料有几十g,不少是个人付费购买的。包括al brooks的视频课程是我在12年购买然后免费分享的,现在各位保留的拷贝我相信最初都来自于我。我推荐三位真正的交易高手,一个是forexmentor网站的chris lori.他的课程涵盖内容十分广泛,适合初学者快速入门。一个是al brooks,这个不用讲,基本是所有的pa课程都会引用他的课程内容,特别是他的课程核心m2e,m2s策略甚至是许多交易者唯一研究并且使用的交易策略。再一个是hector deville,他的pa课程亦十分具有实战性,对于中长线交易者真是不可多得。另外他的BPC进场法也属于chart pattern entry之一。你可以拿nail的课程和我推荐的几位交易者的课程内容对比,孰高孰低,自会有判断。

我总结的二次进场,6条规则,陷阱交易,对抗弱势等。以后我依情况进行部分细节讲解。本人的整个交易系统,都有理有据。大多是个人实践中 的总结和各交易者的课程内容整合。

有需求实盘分析的朋友,可以在此留言,我会简要解答下我的交易思路。否则,本人的截图全部来自于过往交易记录。谢谢合作。捣乱的朋友请不要再无故吐槽。本人已删除任何联系方式。

韬客社区www.talkfx.co

发表于:2014-08-15 14:02只看该作者

105楼

[quote][color=#999999]mantisli 脙鈥毭偮访冣

● 新来会员请务必仔细阅读韬客外汇论坛汇友必读

并前往新手疑问解答和社区事务浏览了解论坛如何使用以及各板块情况。

● 对管理有意见或建议请到社区事务提出. 不听规劝一味在主版汇市讨论区纠缠扰乱秩序者会被处理。

● 为维护论坛秩序,欢迎举报非广告区和个人短信里的广告拉客,一经查实.将对举报者加分奖励!

发表于:2014-08-15 14:02只看该作者

106楼

要向前辈的贴子多看,多学,多练,少说

发表于:2014-08-16 09:04只看该作者

107楼

不论是什么 我只吸收有用的 我不去评论你是否裸K 不去看你是否拉人 知识是第一生产力 对我有用的吸收就好 鉴定完毕~~~·

韬客社区www.talkfx.co

发表于:2014-08-16 15:30只看该作者

108楼

不是裸k

韬客社区www.talkfx.co

发表于:2014-08-16 15:41只看该作者

109楼

我理解的裸k是这样的

韬客社区www.talkfx.co

110楼

韬客社区www.talkfx.co

111楼

本帖最后由 mantisli 于 2014-8-17 08:03 编辑 此截图希望各位收藏,极其重要。是PA进阶学习的重要一步。 至此,本人的交易系统已经透露了70%左右。余下30%核心内容暂告更新。各位消化先。谢谢支持。

韬客社区www.talkfx.co

发表于:2014-08-17 00:14只看该作者

112楼

韬客社区www.talkfx.co

113楼

恭喜作空美股德股的朋友们,联储的朋友又来消息了,你们懂的

左侧进场右侧出场

114楼

韬客社区www.talkfx.co

发表于:2014-08-17 02:41只看该作者

115楼

韬客社区www.talkfx.co

发表于:2014-08-17 15:02只看该作者

117楼

第二階跨第三階中。。。(2024)又五年过去了,才知道自己还没有进入第二阶

发表于:2014-08-17 15:33只看该作者

118楼

韬客社区www.talkfx.co

发表于:2014-08-17 15:35只看该作者

119楼

英文不太好,翻译不对的地方高手指正。

Set and Forget Forex Trading – Keep Your Day Job

‘Set and Forget Forex Trading’ is as simple as its name implies; you simply “set” the trade up and then “forget” about it for a period of time. This has two major benefits: it makes it far easier to stay emotionally disciplined and it also allows you to go about your life as you normally would, because you will not be spending hours in front of your computer over-analyzing the markets…“一劳永逸外汇交易”很简单,顾名思义;你简单的“设置”贸易起来,然后“不管”它一段时间。这有两大好处:它使我们更容易保持情绪纪律,它也可以让你像往常一样去了解你的生活,因为你不会在你的电脑前花费数小时,分析市场...Often, aspiring Forex traders become lost in a web of confusion with the amount of data that the various financial media outlets plaster all over the internet and television. It is extremely easy to experience “analysis paralysis” while trying to trade forex or any market for that matter. There are so many competing ideas and trading methods along with more fundamental data coming out every day than you could ever hope to digest, it can be overwhelming to even try and make sense of it all and develop a forex trading plan based off this amount of information. One of the biggest psychological mistakes that almost every aspiring trader makes on their journey to success is firmly believing that the amount of economic data analyzed and (or) having a technically complicated or expensive trading method will help them profit in the market. In reality, as most professional traders will attest to, these factors usually have the opposite effect on trading profits, at least after certain point. This essentially means that once you do a certain amount of analyzing market data, any further time spent analyzing this data is likely to have a negative effect on your trading; it causes you to lose money.通常情况下,有野心的外汇交易者变得迷失和混乱在网络与数据在大量的金融媒体互联网和电视。这是非常容易体验到“分析瘫痪”,而试图贸易外汇或任何市场为此事。有这么多的竞争观念和伴随着更多的基础数据出来每一天比你所能希望能消化的交易方法,也可以是铺天盖地,甚至试图让这一切的感觉,并制定了基于这一数额的外汇交易计划信息。其中一个最大的心理失误,几乎每一个有抱负的交易者,使他们的成功之旅坚定地认为经济数据的数量分析和具有技术复杂或昂贵的交易方法将帮助他们盈利的市场。在现实中,作为最专业的交易员将证明,这些因素通常对交易利润产生相反的效果,至少要经过某一点。这实际上意味着,一旦你做了一定的分析市场数据,分析了该数据的任何进一步的时间很可能对你的交易产生负面影响;它会导致你赔钱。Why it’s Counter Productive to Analyze too Much Market Data为什么分析太多的市场数据会产生反效果It may seem confusing or counter intuitive to the aspiring Forex trader when they first hear the fact that analyzing too much market data can actually cause you to lose money faster than you other wise would. The believe that “more is better”, is a psychological trap that often keeps aspiring traders from consistently profiting in the Forex market and is the reason why many of them blow out their trading accounts and eventually give up all together.这似乎令人困惑或直觉对有抱负的外汇交易者,当人们第一次听到的事实关于分析了太多的市场数据实际上可以导致你失去的钱比你用其他方式输钱。在认为“越多越好”上,是一种心理的陷阱,往往从保持一贯获利在外汇市场有抱负的交易者,为什么很多人吹出来的交易账户,并最终放弃了一起的原因。The main reason why this occurs is because human beings have an innate need to feel in control of their life and of their surroundings, it is an evolutionary trait that has allowed our species to perpetuate its existence and ultimately arrive at our current modern day level of civilization. Unfortunately, for the aspiring Forex trader, this genetic trait of all human beings works against those trying to succeed at Forex trading. In fact, most of our normal feelings of wanting to work harder than the next guy or spend extra time studying and researching for our jobs or for school are feelings that are really not beneficial to success in the Forex market.为什么出现这种情况的主要原因是因为人类有一种与生俱来的必要:感到在他们周围的生活更容易控制,这是一个渐进的特质,已经允许我们的物种延续它的存在,并最终到达我们目前的现代水平文明。不幸的是,有抱负的外汇交易,所有人类的这种遗传性状的作品对那些试图在外汇交易成功。事实上,我们的大多数想要正常的工作比别人更难或花费额外的时间学习,为我们的工作或学校研究的感情是感情,真的是不要在外汇市场上的成功有利的。The problem with trying to apply the idea of “hard work” to Forex trading, is that beyond a certain level of technical chart reading ability and awareness, there really is no beneficial aspect to spending more time on tweaking a trading system or analyzing more economic reports. The bottom line here is that there are literally millions of variables involved in trading the Forex market; each person trading the market is a variable and every one of their thoughts about the market is a variable because these are all things that can cause price to move. So, unless you are somehow able to keep track of every trader in the market and all of their thoughts, in addition to the hundreds of news and economic reports that come out each day, you essentially have no control over price movement. Trying to analyze numerous pieces of economic data each day or trying to come up with an overly complicated trading method is essentially just a futile attempt to control something that simply cannot be controlled; the market.试图以“艰苦创业”的理念应用到外汇交易的问题,是超出了技术图表的阅读能力和意识在一定的水平,真的是在扭捏交易系统或分析更多的经济花费更多的时间没有有利的方面报告。这里的底线是,有数百万名参与外汇市场交易存在变数;每个人交易市场是一个变量和每一个他们对市场的想法是一个变量,因为这些是所有的东西,可能会导致价格移动。所以,除非你是在某种程度上能够跟踪市场每个交易者和所有他们的思想,除了数百新闻和经济报道每天说出来,你必须要有对价格变动的控制。试着每天来分析无数件的经济数据或试图想出一个过于复杂的交易方式是本质上只是一个妄图控制的东西,根本无法控制;市场。Thus, the underlying cause of Forex trading failure begins with the idea that traders feel a psychological need to control their surroundings and when this emotional state meets the uncontrollable world of Forex trading it almost always has negative consequences. This problem works to snow-ball itself as well because once a trader loses a few trades he or she begins to get angry and wants to “get back” at the market. The way they do this is by reading another trading book or buying a different trading system that seems more “likely to work” or by analyzing the inner workings of every economic report they can find and trying to predict how it will affect the market’s price movement. Once this process has begun it is very difficult to stop because it makes logical sense to us that if we put more time in and do more work we will eventually figure out how to make more money faster in the Forex market. The difficult truth to all of this is that, as stated earlier, after you reach a certain degree of technical and fundamental understanding, any further research or system “tweaking” beyond that point will actually work against you and the rate at which you study more and do more research is probably about the rate at which you will lose your money in the market.因此,外汇交易失败的根本原因开始的想法,贸易商感到一种心理需要控制自己的环境,当这种情绪状态符合外汇交易的不可控的世界几乎总是有负面影响。这个问题工程雪球本身以及因为一旦一个交易者失去了几个行业,他或她就开始生气,想“找回”的市场。他们做到这一点的方法是通过阅读其他交易账户或购买,这似乎更“容易的工作”或通过分析每一个经济报告的内部运作,他们可以找到并试图预测它会如何影响市场的价格变动不同的交易系统。一旦这个过程已经开始很难停止,因为它使逻辑意义上我们说,如果我们把更多的时间,做更多的工作,我们将最终弄清楚如何赚更多的钱快于外汇市场。难的真理这一切的是,如前所述,你达到了一定程度的技术面和基本面的了解后,任何进一步的研究或系统“调整”超越这一点,实际上对你和你学习更多的工作速度和做更多的研究大概是在你将失去你的钱在市场上的利率。Less is more in Forex: ‘Set it and Forget it’少即是多在外汇:'设置它和忘记它“So how does the aspiring trader achieve consistent profitability trading the Forex market if we are genetically primed to over-complicate it? The very first step in this process is just accepting the fact that you cannot control the uncontrollable Forex market and checking your ego at the door. The Forex market does not care what you have done in your life before; it has no emotion and is not a living entity. It is an arena where human beings act out their beliefs about the exchange rate of a certain currency pair. These beliefs are a result of emotions, and human emotion is very predictable when it comes to money. The point here is that the people mentioned in the previous section who are doing extensive amounts of research and trying to find the “holy grail” trading system are the ones who are trying to control the market and thus trading based off emotion. These people are providing the predictability for the professionals to take advantage of.那么,如何让有抱负的交易者实现持续盈利交易的外汇市场,如果我们的基因引物过度复杂化呢?在这个过程中的第一步,只是接受这个事实,你无法控制无法控制的外汇市场,并在门口检查你的自我。外汇市场并不关心你在你的生活之前就完成;它没有情感,不是一个活生生的实体。这是一个舞台,人类表演出来他们对某一货币对的汇率信念。这些信念是情绪的结果,与人类的情感是非常可预测的,当涉及到金钱。这里的要点是,在上一节谁在做大量金额的研究,试图找到“圣杯”的交易系统中提到的人是那些谁试图控制市场,因此基于交易过的情感。这些人所提供的可预见性的专业人士有机可乘。The paradox here is that professional traders may actually do less technical and fundamental “homework” than amateur / struggling traders; pro traders have mastered their trading strategy and they simply stick to their daily trading routine and see if their edge is there. If there edge is not present, then they just walk away for a while because they know that the Forex market is a continuous stream of self-generating opportunities, thus they do not feel pressured or anxious to trade. If their edge does show up then they set their orders and walk away, accepting the fact that any further action will probably work against them because it will be a vain attempt to control the uncontrollable and would not be an objective action.这里的悖论是专业交易者实际上可能少做技术面和基本面的“功课”比业余者;职业交易者已经掌握了自己的交易策略,他们只是坚持自己的每日交易惯例,看看他们的优势是存在的。如果有边不存在,那么他们就这样走开了一会儿,因为他们知道,外汇市场是自我创造机会络绎不绝,因此,他们并不感到有压力或焦虑贸易。如果他们的优势就显示出来,然后把他们的订单,然后走开,接受一个事实,即任何进一步的行动可能会影响他们,因为这将是一个妄图控制却无法控制的,也不会是一个客观的行动。The logic of set and forget forex trading is this; if your trading edge is present then you execute your edge and do not involve yourself further in the process unless you have a valid price action-based reason to do so. Traders that decide to mess with or tweak their trade once they enter it almost always kick start an emotional roller coaster that leads to over-trading, increasing position size, moving their stop loss further from their entry, or moving their profit target further out for no logical reason. These actions almost always cause the trader to lose money because they were not objectively thought out, but were instead influenced by an emotional reaction that was caused by trying to control the uncontrollable.设置和忘记外汇交易的逻辑是这样的;如果你的交易优势存在,那么你执行你的优势,不要再涉及自己在这个过程中,除非你有一个有效的价格行动为基础的理由这样做。该决定或调整他们的贸易,一旦他们进入了交易者几乎总是开始的情感过山车,导致过度交易,增加头寸规模,从他们入境进一步将他们的止损或移动自己的利润目标再出没有合乎逻辑的理由。这些行动几乎总是会导致交易者亏钱,因为他们不是客观地想出来的,而是被代替了,是由试图控制造成难以控制的情绪反应的影响。In the chart below, we see an example of how many traders get into trouble by being too involved with their trades. As the market retraced back toward the entry point of the pin bar sell signal, emotional traders would have probably exited for a very small profit or near breakeven because they felt “scared” or “nervous” that they might lose money on the trade.在下面的图中,我们看到了许多交易者是如何陷入困境因为过于参与他们的交易的例子。随着市场的回抽走回针杆卖出信号的切入点,情感贸易商将有可能退出一个非常小的利润或接近盈亏平衡,因为他们觉得“吓”或“神经”,他们可能会失去金钱上的交易。 In the chart below, we can see that just as the market got to about the low of the pin bar sell signal where most traders would have entered, it stalled and then fell significantly lower back in-line with the downtrend. Disciplined traders who do not “meddle” in their trades for no reason would probably have still been short and would have clearly made a very nice gain. Note how a traders could have waited for an opposing obvious price action buy signal to exit the trade…this is exiting on logic and price action rather than emotions like fear or greed.在下面的图表中,我们可以看到,正如市场得到了什么地方多数交易商将纷纷进入卖出信号的低点,它停顿,然后用跌势显著较低的回落符合预期。纪律的交易者在他们的行业不“染指”没有任何理由很可能仍然是短,会明显地取得了非常不错的收益。请注意如何一个商人可能已经等了一个相对明显的价格行动的买入信号,退出交易...这是退出的逻辑和价格行动,而不是像恐惧或贪婪的情绪。 Make Money and Save Time by Doing…Less?使通过赚金钱和节省时间...或者少点?It is a well-studied fact that traders who trade off higher time frames such as 4 hour, daily, and weekly charts and hold their positions for multiple days, make more money in the long run that traders who “day trade” off intra-day charts. The reason many people are attracted to day trading is because they feel more in control of the market by looking at smaller time frames and jumping in and out of positions frequently. Unfortunately for them, they have not figured out that they have the same amount of control as the swing trader who holds positions for a week or more and only looks at the market for twenty minutes a day or even less. That is to say, neither trader has any control over the market, but day-trading and scalping gives traders the illusion of more control. The only thing we really have control over in trading, is ourselves.这是一个良好的研究事实,谁权衡较高的时间段,如4小时,每日和每周图表并保持其多天,赚更多的钱从长远来看商人,商人“当日交易”关内天图表。很多人被吸引到当日交易的原因是因为他们通过观察更小的时间框架和进出仓频繁跳跃的感觉更加对市场的控制。不幸的是他们,他们还没有想通了,他们所控制的相同数量的摆动交易商谁拥有了一个星期或更多的位置,只着眼于市场一天甚至更少二十分钟。也就是说,既不是交易者对市场的任何控制,但日间交易和倒卖给了贸易商更多的控制的错觉。我们真的有控制权交易中的唯一的事情,就是我们自己。The ironic fact about Forex trading is that spending less time analyzing data and finding the “perfect trading system” will actually cause you to make more money faster because you will be more relaxed, less emotional, and thus less likely to over-trade or over-leverage your trading account. Many people are attracted to speculative trading because they want a way to make money that is “less difficult” than their current job, but they soon forget about that and start spending countless hours digging themselves into a huge psychological trap that most of them never dig out of. All you basically need to do to consistently make money in Forex is master an effecting trading method, develop a written out trading plan based on this method and have a solid risk management strategy, you can then check the market one to three times a day for ten to twenty minutes each time. If your edge (price action strategies) is showing up than you set up your entry, stop loss, and target and walk away until the next scheduled time to check your trades.关于外汇交易具有讽刺意味的事实是,花费更少的时间来分析数据,寻找“完美的交易系统”实际上将导致你赚更多的钱更快,因为你会更轻松,更少情绪,因而不太可能在贸易或以上杠杆您的交易账户。很多人是因为他们想办法赚钱,就是“少难”比他们目前的工作被吸引到投机交易,但他们很快就忘了这一点,开始花费无数的时间挖成一座巨大的心理陷阱,他们大多数从来没有挖出。所有你基本上需要做的,一贯赚钱外汇交易是一个高手影响交易方法,开发了基于这种方法写出来的交易计划,并有健全的风险管理策略,你可以再检查市场之一,每天三次十到二十分钟开放时间。如果你的优势(价格行动策略)是显示了比您设置的条目,止损和目标,然后走开,直到下一个预定的时间来检查你的交易。Trading in this manner actually elicits a snowball of positive habits that work to further perpetuate your trading success. This entire article can be summarized by the following two sentenes: People who spend more time analyzing market data and trying to perfect their trading system inevitably induce a cycle of emotional mistakes that work to increase their trading failures and eventually result in lost money and lost time. People who realize that the market is uncontrollable and build their trading plan around this fact will inevitably arrive at a “set and forget” type mentality that induces an emotional state that is conducive to on-going market success and consistent profitability. The trading method used is not as important as the psychological or risk management aspects of trading, but generally speaking, a method that offers a simple high-probability edge such as the price action trading method that I teach in my price action trading course, is the best method to use to maintain your “set and forget” mindset.这种方式交易实际上引发的是积极的工作习惯一个雪球,进一步延续你的交易的成功。这整篇文章可以概括为以下两个sentenes:谁花更多的时间分析市场数据,并试图完善其交易系统的人不可避免地诱发的工作,以增加交易的失败情绪的错误循环,并最终导致失去金钱,失去的时间。人谁知道,市场是不可控的,并围绕这一事实交易计划将不可避免地得出一个“一劳永逸”式的心态,导致情绪状态有利于持续的市场成功和持续盈利。所使用的交易方法是不一样的交易心理和风险管理方面的重要,但一般来讲,一个方法,提供了一个简单的高概率优势,例如,我教我的价格行动交易过程中的价格行为的交易方法,是用来维持你的“一劳永逸”的心态是最好的方法。

韬客社区www.talkfx.co

发表于:2014-08-17 15:41只看该作者

120楼

韬客社区www.talkfx.co

发表于:2014-08-17 16:53只看该作者

121楼

不对任何交易手法作评论,楼主的分享精神还是值得敬佩,投机这行能生存到最后的才是赢家,适合自己的才是最好的。。。

韬客社区www.talkfx.co

发表于:2014-08-18 03:50只看该作者

122楼

楼主什么是陷阱交易。

韬客社区www.talkfx.co