唯象区位流:价为PA,PRICE ACTION 新方法

41楼 电梯直达

41楼 电梯直达 本帖最后由 精工美元 于 2013-5-10 23:25 编辑

余下的图,,,,7日欧元 M头也叫双顶,跌破可空

EU75-85.jpg

EU75-85.jpg

EU75-85.jpg

EU75-85.jpg42楼

虚拟小时图吞噬线法技术止损:

除了50点和75点止损外,唯象区位流PA 交易的技术止损还有:

虚拟小时图吞噬线法技术止损:设想小和INSIDE BAR 后,或区间各顶底被破时,

就是吞噬线出动,所以技术止损可以用小时图的下一根设想为虚拟的大吞噬线。这样可以

看出止损设在那里,虚拟总设想下一根是:大或长K线。这个就象日图的样子,

但是,我们假设信号棒后下一根小时线就是吞噬长K线.

STOPL exam--.jpg

STOPL exam--.jpg

STOPL exam--.jpg

STOPL exam--.jpg韬客社区www.talkfx.co

43楼

一个方法,也可以通过小帐号全程反映,动态的进场“就备”模式SETUP,识别和买卖是否达到赢利利器的水平和事后是两码事。

最后,看方法是一方面,但是帐号资金曲线更反应了看人的方面,单是对的?其实先看人是对的才重要。

韬客社区www.talkfx.co

44楼

MT4 平台的模版和 指标:

-------------------------

//+------------------------------------------------------------------+

//| Market_Open_Lines.mq4 |

//| Copyright © 2008, NuckingFuts |

//| Revisions to make version c by smjones|

//+------------------------------------------------------------------+

#property indicator_chart_window

#property copyright "Copyright © 2008, NuckingFuts"

#property link "www.forexfactory.com"

extern int NumberOfBars = 500;

extern string Note = "0 means Display all bars";

extern int Sydney_Open = 17;

extern int Tokyo_Open = 20;

extern int Frank_Open = 2;

extern int London_Open = 4;

extern int London_Close = 12;

extern int NY_Open = 8;

extern color SydneyColor = Tomato;

extern color TokyoColor = Magenta;

extern color FrankColor = Lime;

extern color LondonColor = Yellow;

extern color NYColor = DeepSkyBlue;

extern int LabelFontSize = 9;

datetime printonce = 0;

//+------------------------------------------------------------------+

//| Custom indicator initialization function |

//+------------------------------------------------------------------+

int init()

{

return(0);

}

//+------------------------------------------------------------------+

//| Custor indicator deinitialization function |

//+------------------------------------------------------------------+

int deinit()

{

string name;

bool done;

while ( true )

{

done = true;

for ( int i=0; i 1hr, don't draw open lines */

if (Period() > PERIOD_H1) return(0);

double loc;

string today;

int limit, ihour;

int counted_bars=IndicatorCounted();

//---- last counted bar will be recounted

if(counted_bars>0) counted_bars--;

if ( NumberOfBars == 0 )

NumberOfBars = Bars-counted_bars;

limit=NumberOfBars; //Bars-counted_bars;

for(int i=0; i

46楼

本帖最后由 精工美元 于 2013-5-12 20:10 编辑

有道字典:

价格行为

用简单的术语来表达 价格行为 (price action)就是说它是对价格的“研究”,表达价格是如何运动的,是如何对支撑和压力位做出响应的。

另外 Al Brooks2012年书总词汇表: 这楼补些 PRICE ACTION 术语的翻译: major trend line Any trend line that contains most of the price action on the screen and is typically drawn using bars that are at least 10 bars apart. 主趋势线:能把屏幕中的多数价格行为包含在内的任何趋势线,一般用至少多过10根的棒线来画 major trend reversal A reversal from a bull to a bear trend or from a bear trend to a bull trend. The setup must include a test of the old trend extreme after a break of the trend line. 主趋势逆转(反转):一个上升趋势变下降趋势或下降趋势变上升趋势的逆转,一个进场“就备”模式必须包括(前面)打破一次趋势线后,走势(退着)对旧的趋势之极端点的测试 meltdown A sell-off in a bear spike or a tight bear channel without significant pullbacks and that extends further than the fundamentals would dictate. 熔破跌:在大跌激突行情后再卖空抛售的行情,或在并无显著回撤的紧窄下降铜道后的卖出行情。这卖出之跌的程度还远超过通常基本面所指谓的程度。 melt-up A rally in a bull spike or a tight bull channel without significant pullbacks and that extends further than the fundamentals would dictate. 熔破涨: 在大涨激突行情后再升起的行情,或在并无显著回撤的紧窄上升通道后的买进行情。 这买进之涨的程度还远超过通常基本面所指谓的程度。 micro Any traditional pattern can form over one to about five bars and still be valid, although easily overlooked. When it forms, it is a micro version of the pattern. Every micro pattern is a traditional pattern on a smaller time frame chart, and every traditional pattern is a micro pattern on a higher time frame chart. 微小 (微小版本的):任何一个传统意义上的形态(图形模式)也能在1到 5个 棒内就形成,虽然这些较短期的形态容易被忽视,但仍然是有效的形态。将某图形态放大则视如传统形态样子,但因短到1到5根棒,故实为微小版本的该形态(图形模式)。任何微小模式(形态)都是更小时间周期框架图上的传统形态,而任何传统形态也是在更高时间周期框架下视如一微小形态的。 micro channel A very tight channel where most of the bars have their highs and lows touching the trend line and, often, also the trend channel line. It is the most extreme form of a tight channel, and it has no pullbacks or only one or two small Pullbacks. 微小通道: 很紧的一种通道,同时它们的棒顶和底都多数触及到该(微小)趋势线了,更常常是也触及趋势通道线了。这确实是极端形式的紧通道,并且没什么回撤,或只有很小的回撤。 LIST OF TERMS USED IN THIS BOOK xix micro double bottom moving average gap bar (gap bar) A bar that does not touch the moving average. The space between the bar and the moving average is the gap. The first pullback in a strong trend that results in a moving average gap bar is usually followed by a test of the trend's extreme. For example, when there is a strong bull trend and there is a pullback that finally has a bar with a high below the moving average, this is often a buy setup for a test of the high of the trend. 移动均线缺口棒(缺口棒): 一个没有接触20EMA移动均线的棒(即离开了均线)。这样在棒和均线之间有个缺口。在强趋势里走的第一个回撤一般会导致在一个均线缺口棒之后,接着作测试趋势之端点的动作。例如,在强涨势里,有个回撤过程其终点形成一个棒子且因为回撤跌的缘故而跌到均线下,就是该棒上面和20EMA均线有个缺口。这个情况是做多的进场“就备”模式,其期望行情 奔测至少到前极端高。 nesting Sometimes a pattern has a smaller version of a comparable pattern “nested” within it. For example, it is common for the right shoulder of a head and shoulders top to be either a small head and shoulders top or a double top. 嵌套着:有时,某个可比相类似的小版本形态内置嵌套在本级形态的一段内。例如,常见情况是,一个头肩顶的头部本身可能是一个小型头肩顶,或一个双头(即双顶)。 news Useless information generated by the media for the sole purpose of selling advertising and making money for the media company. It is unrelated to trading, is impossible to evaluate, and should always be ignored. 新闻(消息):媒体产生的无用信息,媒体不过是用作卖广告为媒体公司挣钱而矣,这些消息和交易无关,故应当恒久地忽视掉这些消息。 oio Outside-inside-outside, an outside bar followed by an inside bar, followed by an outside bar. oio(外包线-内蕴线-外包线)一个外包较长K烛接小的内蕴线,之后在接外包线。 oo Outside-outside, an outside bar followed by a larger outside bar. oo (外线-外包线),一个外包线接一个更长的外包线。 opening reversal A reversal in the first hour or so of the day. 开盘逆转(开盘反转):当日开盘一小时(或一小时左右)时段发生的逆转(反转)。 outside bar A bar with a high that is above or at the high of the prior bar and a low that is below the low of the prior bar, or a bar with a low that is below or at the low of the prior bar and a high that is above the high of the prior bar. 外包线(棒、烛),相对前棒该外包棒的高要高过或等于前棒顶,且该外包棒的低要低于前棒底;另外情况是, 相对前棒该外包棒的低要低过或等于前棒底,且该外包棒的高要高于前棒顶。 outside down bar An outside bar with a close below its open. 下降外包线:外包线的收盘价是低于其开盘的(阴线)。 outside up bar An outside bar with a close above its open. 上升外包线:外包线的收盘价高于其开盘的(阳线)。

用简单的术语来表达 价格行为 (price action)就是说它是对价格的“研究”,表达价格是如何运动的,是如何对支撑和压力位做出响应的。

另外 Al Brooks2012年书总词汇表: 这楼补些 PRICE ACTION 术语的翻译: major trend line Any trend line that contains most of the price action on the screen and is typically drawn using bars that are at least 10 bars apart. 主趋势线:能把屏幕中的多数价格行为包含在内的任何趋势线,一般用至少多过10根的棒线来画 major trend reversal A reversal from a bull to a bear trend or from a bear trend to a bull trend. The setup must include a test of the old trend extreme after a break of the trend line. 主趋势逆转(反转):一个上升趋势变下降趋势或下降趋势变上升趋势的逆转,一个进场“就备”模式必须包括(前面)打破一次趋势线后,走势(退着)对旧的趋势之极端点的测试 meltdown A sell-off in a bear spike or a tight bear channel without significant pullbacks and that extends further than the fundamentals would dictate. 熔破跌:在大跌激突行情后再卖空抛售的行情,或在并无显著回撤的紧窄下降铜道后的卖出行情。这卖出之跌的程度还远超过通常基本面所指谓的程度。 melt-up A rally in a bull spike or a tight bull channel without significant pullbacks and that extends further than the fundamentals would dictate. 熔破涨: 在大涨激突行情后再升起的行情,或在并无显著回撤的紧窄上升通道后的买进行情。 这买进之涨的程度还远超过通常基本面所指谓的程度。 micro Any traditional pattern can form over one to about five bars and still be valid, although easily overlooked. When it forms, it is a micro version of the pattern. Every micro pattern is a traditional pattern on a smaller time frame chart, and every traditional pattern is a micro pattern on a higher time frame chart. 微小 (微小版本的):任何一个传统意义上的形态(图形模式)也能在1到 5个 棒内就形成,虽然这些较短期的形态容易被忽视,但仍然是有效的形态。将某图形态放大则视如传统形态样子,但因短到1到5根棒,故实为微小版本的该形态(图形模式)。任何微小模式(形态)都是更小时间周期框架图上的传统形态,而任何传统形态也是在更高时间周期框架下视如一微小形态的。 micro channel A very tight channel where most of the bars have their highs and lows touching the trend line and, often, also the trend channel line. It is the most extreme form of a tight channel, and it has no pullbacks or only one or two small Pullbacks. 微小通道: 很紧的一种通道,同时它们的棒顶和底都多数触及到该(微小)趋势线了,更常常是也触及趋势通道线了。这确实是极端形式的紧通道,并且没什么回撤,或只有很小的回撤。 LIST OF TERMS USED IN THIS BOOK xix micro double bottom moving average gap bar (gap bar) A bar that does not touch the moving average. The space between the bar and the moving average is the gap. The first pullback in a strong trend that results in a moving average gap bar is usually followed by a test of the trend's extreme. For example, when there is a strong bull trend and there is a pullback that finally has a bar with a high below the moving average, this is often a buy setup for a test of the high of the trend. 移动均线缺口棒(缺口棒): 一个没有接触20EMA移动均线的棒(即离开了均线)。这样在棒和均线之间有个缺口。在强趋势里走的第一个回撤一般会导致在一个均线缺口棒之后,接着作测试趋势之端点的动作。例如,在强涨势里,有个回撤过程其终点形成一个棒子且因为回撤跌的缘故而跌到均线下,就是该棒上面和20EMA均线有个缺口。这个情况是做多的进场“就备”模式,其期望行情 奔测至少到前极端高。 nesting Sometimes a pattern has a smaller version of a comparable pattern “nested” within it. For example, it is common for the right shoulder of a head and shoulders top to be either a small head and shoulders top or a double top. 嵌套着:有时,某个可比相类似的小版本形态内置嵌套在本级形态的一段内。例如,常见情况是,一个头肩顶的头部本身可能是一个小型头肩顶,或一个双头(即双顶)。 news Useless information generated by the media for the sole purpose of selling advertising and making money for the media company. It is unrelated to trading, is impossible to evaluate, and should always be ignored. 新闻(消息):媒体产生的无用信息,媒体不过是用作卖广告为媒体公司挣钱而矣,这些消息和交易无关,故应当恒久地忽视掉这些消息。 oio Outside-inside-outside, an outside bar followed by an inside bar, followed by an outside bar. oio(外包线-内蕴线-外包线)一个外包较长K烛接小的内蕴线,之后在接外包线。 oo Outside-outside, an outside bar followed by a larger outside bar. oo (外线-外包线),一个外包线接一个更长的外包线。 opening reversal A reversal in the first hour or so of the day. 开盘逆转(开盘反转):当日开盘一小时(或一小时左右)时段发生的逆转(反转)。 outside bar A bar with a high that is above or at the high of the prior bar and a low that is below the low of the prior bar, or a bar with a low that is below or at the low of the prior bar and a high that is above the high of the prior bar. 外包线(棒、烛),相对前棒该外包棒的高要高过或等于前棒顶,且该外包棒的低要低于前棒底;另外情况是, 相对前棒该外包棒的低要低过或等于前棒底,且该外包棒的高要高于前棒顶。 outside down bar An outside bar with a close below its open. 下降外包线:外包线的收盘价是低于其开盘的(阴线)。 outside up bar An outside bar with a close above its open. 上升外包线:外包线的收盘价高于其开盘的(阳线)。

韬客社区www.talkfx.co

47楼

周一典型小行情:

CSMALL5-13-.jpg

CSMALL5-13-.jpg

CSMALL5-13-.jpg

CSMALL5-13-.jpg韬客社区www.talkfx.co

48楼

overshoot The market surpasses a prior price of significance like a swing point or a trend line.

过头行情:市场行情逾过一个象前摆动行情的极点或某趋势线之类的前期价格的显著点或段。

pause bar A bar that does not extend the trend. In a bull trend, a pause bar has a high that is at or below the prior bar, or a small bar with a high that is only a tick or so higher than the previous bar when the previous bar is a strong bull trend bar. It is a type of pullback.

暂停棒:行情没继续延展趋势而停顿的棒烛称之。在一个上升趋势里,一个暂停棒要求其高点比前棒的顶低或持平,或者暂停棒本身是相对前棒的内蕴线,该内蕴线的顶可以比紧前的强升趋势棒的顶仅高过差不多一个点而已,暂停棒算是一个类型的回撤。

pip A tick in the foreign exchange (forex) market. However, some data vendors provide quotes with an extra decimal place, which should be ignored.

点(同义:最小记点):外汇市场正常整点成交的点数,但是要忽视某些交易上提供的例外报价精度而给的小数(不记比一个点还小的小数)。

pressing their longs In a bull trend, bulls add to their longs as in a bull spike and as the market breaks out to a new high, because they expect another leg up to about a measured move.

已多而添迫(加油):在上升趋势里,当涨势激突行情期间或当市场突破走向新高时,加添头寸做多交易者们已经持有的多向仓位。因为他们希望行情会再按前面段(肢、LEG)幅度近等距的幅度再升起一肢(即段)。

pressing their shorts In a bear trend, bears add to their shorts in a bear spike and as the market breaks out to a new low, because they expect another leg down to about a measured move.

已空而添迫(加油):在下降趋势里,当跌势激突行情期间或当市场突破走向新低时,加添头寸做空交易者们已经持有的沽空仓位。因为他们希望行情会再按前面段(肢、LEG)幅度近等距的幅度再跌起一肢(即段)。

price action Any change in price on any chart type or time frame.

价格行为,任何时间周期框架下,任何类型图表的任何价格变化(注:内涵是已有图记的任何价格变动!)

probability The chance of success. For example, if a trader looks back at the most recent 100 times a certain setup led to a trade and finds that it led to a profitable trade

60 times, then that would indicate that the setup has about a 60 percent probability of success. There are many variables that can never be fully tested, so probabilities are only approximations and at times can be very misleading.

概率:即衡量成功的机会。例如,如果一个交易者回顾最近的100次的特定形式的进场“就备”模式,将了解到这100可交易的地方包含60次是能赢利的。如此该形式的进场“就备”模式基本应该有60%的成功率。然而还存在很多变量并没有完全得到测试,故各类概率也不过是大概的并且有时还是很误导性的,

Probably: At least 60 percent certain.

可能地:至少有60%的确定。

pullback A temporary pause or countertrend move that is part of a trend, swing, or leg and does not retrace beyond the start of the trend, swing, or leg. It is a small trading range where traders expect the trend to resume soon. For example, a bear pullback is a sideways to upward move in a bear trend, swing, or leg that will be followed by at least a test of the prior low. It can be as small as a one-tick move above the high of the prior bar or it can even be a pause, like an inside bar.

回撤:指存在于一个趋势的、摆动行情的、或肢的一部分行情,它是一个临时暂停或逆趋势运动。它的回向运动返回程度至多100%却不会撤得超过该趋势起始点。回撤,是是一段小交易区间并且交易者期望很快原趋势要恢复运行。例如,在一个下降趋势,跌摆或接下来将归测低点的肢等等 行情里,一个看跌回撤段会呈现奔高的(盘整之)侧向运动。

(对跌的)回撤,可以很小而小到只有一个点的反折:比前棒顶高一个点,或甚至只发生一下停顿而已。

pullback bar A bar that reverses the prior bar by at least one tick. In an uptrend, it is a bar with a low below that of the prior bar.

回撤棒:比前棒至少逆转了一个点的棒。以上升趋势为例,所谓回撤棒就是比其前的棒之底要低些的一个棒烛。

reasonable A setup with a favorable trader's equation.

带合理性的:有利于得到交易者收益期望方程正值的进场“就备”模式。

reversal A change to an opposite type of behavior. Most technicians use the term to mean a change from a bull trend to a bear trend or from a bear trend to a bull trend. However, trading range behavior is opposite to trending behavior, so when a trend becomes a trading range, this is also a reversal. When a trading range becomes a trend, it is a reversal but is usually called a breakout.

逆转(反转):

韬客社区www.talkfx.co

49楼

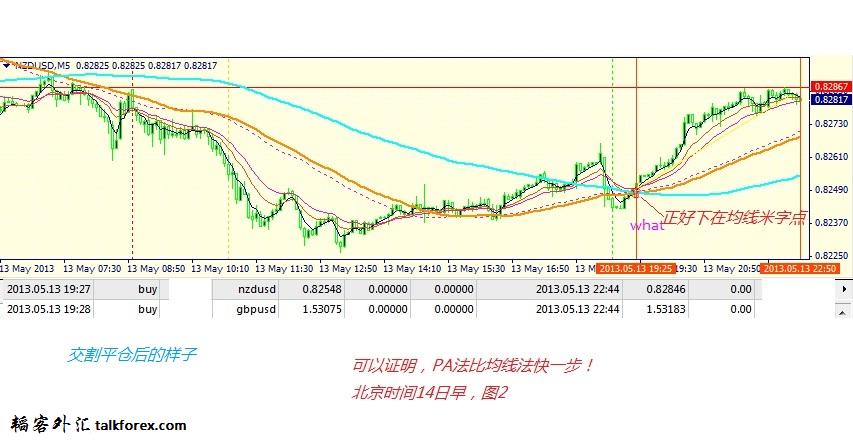

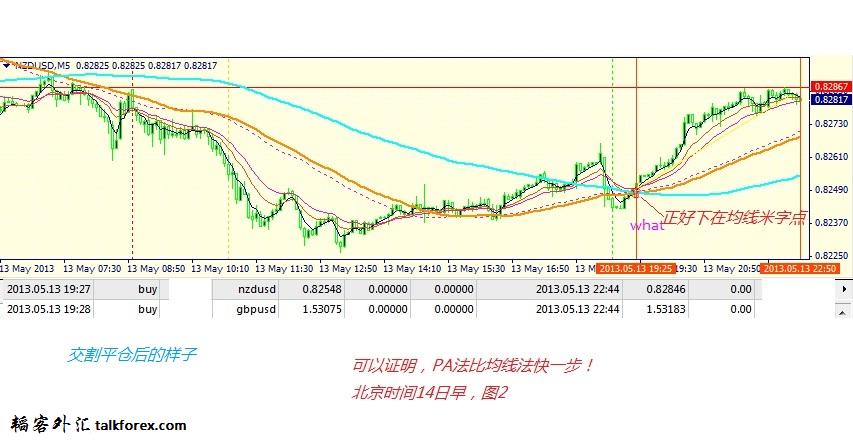

Price Action 价格行为 ,按PA交易,比用均线早一步:米字图:

图一是单子还在,图2是单子平了,注意UJPY按FAKEY卖进场 SETUP 翻译成进场“就备”模式:这图只是示意用的不要太计较:

。

T2-.jpg

T2-.jpg T1-.jpg

T1-.jpg

T2-.jpg

T2-.jpg T1-.jpg

T1-.jpg50楼

翻译,,,,,,,,,,,,,,,

韬客社区www.talkfx.co

51楼

加快给出 Al Brooks 阿尔 布鲁克斯的书的词汇表,这对懂英语却对英语意义不很透撤的人非常有用,

所以,资料如下:

这些资料对阅读并了解 PA 交易办法是有帮助的:

reasonable A setup with a favorable trader's equation.

带合理性的:有利于得到交易者收益期望方程正值的进场“就备”模式。

reversal A change to an opposite type of behavior. Most technicians use the term to mean a change from a bull trend to a bear trend or from a bear trend to a bull trend. However, trading range behavior is opposite to trending behavior, so when a trend becomes a trading range, this is also a reversal. When a trading range becomes a trend, it is a reversal but is usually called a breakout.

逆转(反转):广泛些讲,市场行情行为向相反类别行情行为的转变就算逆(转)了。大多数技术分析者用这个术语是指上升趋势改成了下降趋势或下降趋势变成上升趋势运行(具体是方向)。当然,和趋势性行情行为相反的是区间(盘整)性行情行为,因此,一个趋势变成交易区间了,也算一种逆转(具体是模式之变)。特别在一个交易区间改为趋势行情时也算逆转,不过普通叫做突破。

reversal bar A trend bar in the opposite direction of the trend. When a bear leg is reversing up, a bull reversal bar is a bull trend bar, and the classic description includes a tail at the bottom and a close above the open and near the top. A bear reversal bar is a bear trend bar in a bull leg, and the traditional description includes a tail at the top

and a close below the open and near the bottom.

逆转棒(反转棒烛):某向的趋势里生出一个反向的趋势棒来(趋势棒就是有烛体长度的非盘整型棒)。当一个下跌行情段(或肢)在逆转时,那个生出的逆转棒(看涨),就是看涨趋势棒:很典型的描述就是 此棒(烛)在底部是下影线,而收盘在开盘之上并收在接近棒顶段。

当一个上升行情段(或肢)在逆转时,那个生出的逆转棒(看跌),就是看跌趋势棒:很典型的描述就是 此棒(烛)在顶部是上影线,而收盘在开盘之下并收在接近棒底段。

reward The number of ticks that a trader expects to make from a trade. For example, if the trader exits with a limit order at a profit target, it is the number of ticks between the entry price and the profit target.

回报值(报酬和报偿):一个交易者期望这笔交易赢利的点数。例如 如果交易者设了取赢利限价单放在目标位上,那个从进价到目标价位的点数差就是回报。

risk The number of ticks from a trader's entry price to a protective stop. It is the minimum that the trader will lose if a trade goes against him (slippage and other factors can make the actual risk greater than the theoretical risk).

风险(值):指保护止损位到进场位之间的点数(价格差)。这个点数只是可能至少会损失的点数,当实际行情不利时,这个真损失还和平台滑点和其他影响因素有关,这个实际损失风险程度会比理论上的风险值大一些。

risk off When traders think that the stock market will fall, they become risk averse, sell out of volatile stocks and currencies, and transition into safe-haven investments, like Johnson & Johnson (JNJ), Altria Group (MO), Procter & Gamble (PG), the U.S. dollar, and the Swiss franc.

避险(抗风险类):当交易者们在认为股票大市要跌,他们就变得厌恶风险而规避风险,就会把那些波动率高的股票或币种卖了,而转向避险天堂去投资(买入),比如(买)Johnson & Johnson (JNJ)强生强生, Altria Group (MO)奥驰亚集团公司(万宝路烟等), Procter & Gamble (PG)保洁,(买)避险货币美元和瑞士法郎。

risk on When traders think that the stock market is strong, they are willing to take more risks and invest in stocks that tend to rise faster than the overall market, and invest in more volatile currencies, like the Australian dollar or the Swedish krona.

喜险(风险类,风险时易危的):当交易者们在认为股市稳强中,他们就采取更冒险的策略而选那些比一般股的总体涨得快的股票,也对波动率高的货币进行投资,比如(买)澳大利亚元和瑞典克朗。

risky When the trader's equation is unclear or barely favorable for a trade. It can also mean that the probability of success for a trade is 50 percent or less, regardless of the risk and potential reward.

着风险的:当情形是交易者收益期望方程不清楚或对某个交易仅有一点点利。也可以说是成功的概率是50%或比这还低。这里已经不考虑风险和潜在回报的比率(纯谈成功率)。

scalp A trade that is exited with a small profit, usually before there are any pullbacks. In the Emini, when the average range is about 10 to 15 points, a scalp trade is usually any trade where the goal is less than four points. For the SPY or stocks, it might be 10 to 30 cents. For more expensive stocks, it can be $1 to $2. Since the profit is often smaller than the risk, a trader has to win at least 70 percent of the time, which is an

unrealistic goal for most traders. Traders should take trades only where the potential reward is at least as great as the risk unless they are extremely skilled.

剥头皮:一种只取很少利润就出场的的交易类型。通常都是不等进单后行情回撤发生,交易就结束了。Emini 标普电子盘的交易里,在通常10到15个点的价变区内,一个头皮交易常指那些获利目标少于4个点的交易。而对 SPY和股票市场,也可能是10到30美分的获利。而对那些每股价格很高的,头皮就是只取1美元到2美元就结束的。因为这类交易的获利(回报)常小于风险,所以一个交易者至少胜率要超过70%,而这对多数交易者来说是无法达到的。一般地,除非技术特别突出,交易者要只选回报至少等比于风险,或回报比风险高的交易。

scalper A trader who primarily scalps for small profits, usually using a tight stop.

剥头皮者:通常在设紧止损的条件下,该类交易者主要做得小获利的头皮交易。

scalper's profit A typical amount of profit that a scalper would be targeting.

剥头皮者的利润(头皮利润),一个头皮交易者想要的典型(行情价差表示的)赢利量。

scratch A trade that is close to breakeven with either a small profit or a loss.

出场近入场的擦边性交易:一个交易在保平附近结束,可能赢一点点或稍损一点点。

second entry The second time within a few bars of the first entry where there is an entry bar based on the same logic as the first entry. For example, if a breakout above a wedge bull flag fails and pulls back to a double bottom bull flag, this pullback sets up a second buy signal for the wedge bull flag.

第二次进场(第二入场):根据第一次进场的逻辑同样的逻辑,在第一入场后几根棒,再次符合这逻辑的条件,就是第二次进场。例如,当一个发生在楔形上面的突破走看涨旗形时,

该高位的旗形失败了,然后回撤演成总体如双底部位的看涨旗形。这个(第2)回撤就

就备成第二次买入信号(对前面那个楔形看涨旗形而言的)。

注意 就备=动词了。

second moving average gap bar setup If there is a first moving average gap bar and a reversal toward the moving average does not reach the moving average, and instead the move away from the moving average continues, it is the next reversal in the direction of the moving average.

第二移动均线缺口棒进场“就备”模式:如果存在第一次的移动均线缺口棒,该发生的走势向均线靠拢的逆转段,在逆向均线时没能碰到该20均线,而是继续反离均线更远。

后来走势再次向均线逆转,这就算第二个逆转,行情将向均线靠拢,可称之。

second signal The second time within a few bars of the first signal where there is a setup based on the same logic as the first signal.

selling pressure Strong bears are asserting themselves and their selling is creating bear trend bars, bars with tails at the tops, and two-bar bear reversals. The effect is cumulative and usually is eventually followed by lower prices.

setup A pattern of one or more bars used by traders as the basis to place entry orders. If an entry order is filled, the last bar of the setup becomes the signal bar. Most setups are just a single bar.

第二信号:在第一信号后,行情经历少数棒烛后再呈现的另一信号,且产生这信号的进场“就备”模式是遵循着和第一个信号一样的可入场逻辑的,

selling pressure Strong bears are asserting themselves and their selling is creating

bear trend bars, bars with tails at the tops, and two-bar bear reversals. The

effect is cumulative and usually is eventually followed by lower prices.卖压:强的阴烛自己就在判明这是“卖压”具有的,这些“卖压”的卖出交易活动也产生诸如看跌趋势棒,长上影线的棒烛,和双棒构成的变跌逆转图。这种效应是累积的且通常行情最终随之走向低价。

setup A pattern of one or more bars used by traders as the basis to place entry

orders. If an entry order is filled, the last bar of the setup becomes the signal bar.

Most setups are just a single bar.SETUP 进场“就备”或进场“就备”模式:交易者们用作入场依据的,由一个和多个棒组成的图表模式,在重新定义时,这里的SETUP一词,按定义已经是一种模式了,既然如此,本处定义的setup 可翻译成进场模式。但是如果从词源和动词特征,采用进场“就备”模式也行。如果一个入场单成交了,在成交处,进场“就备”模式的最后一根棒就是信号棒(signal bar).

注意这个成交也可以发生在SETUP的后面。

当成交发生的时候,这发生地即称入场棒(ENTRY BAR)。

当SETUP最后一个棒称为信号棒时,如果情况I:其续后的一个棒才发生成交,

则SETUP后紧随的棒就是入场棒。如果很巧情况II:这个信号棒就成交了,

则这个信号棒也(同)是入场棒。

shaved body A candle with no tail at one or both ends. A shaved top has no tail at the

top and a shaved bottom has no tail at the bottom.

无影线烛体:在一端或两端烛是没有影线的。光头烛是没有顶端上影线的K烛,而光脚烛是没有底端下影线的K烛。

short As a verb, to sell a stock or futures contract to initiate a new position (not to exit a prior purchase). As a noun, a person who sells something short, or the actual position itself.

作空,空,沽空,名词也做“空头”:当成动词时,指卖出股票或期货合约而开立新部位(新单而不是结旧单)。当成名词时指做空的交易者(空方)。也用来指实际(卖而开立)的空头部位本身。

shrinking stairs A stairs pattern where the most recent breakout is smaller than the previous one. It is a series of three or more trending highs in a bull trend or lows in a bear trend where each breakout to a new extreme is by fewer ticks than the prior breakout, indicating waning momentum. It can be a three-push pattern, but it does not have to resemble a wedge and can be any series of broad swings in a trend.

收缩梯形:意指扩张幅度在减少:那些最近期(图表靠右侧)的突破(突破后走的幅度)小于先前的一个突破(按当时突破点起算的幅度)而呈现的梯形模式图。在上升趋势里相当于三个或更多个成系列的高点(H H H,),或在下降趋势里相当于三个或更多个成系列的低点( L L L,),(注:第一个H之幅度比如10,而第二个H是已过前高,在这突破起点往上计算可能只有8,等等)每个新突破,其突破后幅度都衰减几个点。预示动量在衰减。

这个收缩提醒可以是三推(three-push)模式。但是肯定不必和楔形一样。它可以是趋势里的一系列尚宽的摆动行情。

signal bar The bar immediately before the bar in which an entry order is filled (the entry bar). It is the final bar of a setup.

信号棒,是进场就备模式里的最后一个棒,而通常在入场棒(有成交)紧前。但是也有入场棒和信号棒是同一根棒的情况,比如才显现这是个SETUP,而没收盘的信号棒是(当作信号棒并实际下了单)的,这样单子就还没成交,但是突然这个棒子伸长就成交了,而后

才收盘。所以这个棒同时也是 ENTRY BAR入场棒。

smaller time frame (STF) A chart covering the same amount of time as the current chart, but having more bars. For example, compared to the day session 5 minute Emini chart on an average day, examples of smaller time frame charts include a 1 minute chart, a tick chart with 500 ticks per bar, and a volume chart with 1,000 contracts per bar (each of these charts usually has more than 200 bars on an average day, compared to the 81 bars on the 5 minute chart).

较小时间周期框架(STF),和当前图相比,这较小时间周期框架的图包含同样的时间段落。但是却同时用更多根数的棒来表现。例如,在Emini的5分钟图一般性的一天走势段,较小时间周期的图表包含1分钟图、每棒含500成交点的Tick 图、和量图的每根棒子至少1000合约成交。这三类图都是在一天内约200棒烛。而5分钟图表现一日的行情只要81根。

smart traders Consistently profitable traders who are usually trading large positions and are generally on the right side of the market.

聪明交易者:一致保持的赢利性交易者,通常交易比较大部位,并经常站在市场方向的正确的一边。

spike and channel A breakout into a trend in which the follow-through is in the form of a channel where the momentum is less and there is two-sided trading taking place.

激突接通道形:一般走势突破成(较陡)趋势走势然后接着的走势呈现斜通道形式 ,其动量稍减,在此发生双向交易。

Stair

A push to a new extreme in a trending trading range trend or a broad channel

trend where there is a series of three or more trending swings that resembles a sloping trading range and is roughly contained in a channel. After the breakout, there is a breakout pullback that retraces at least slightly into the prior trading range, which is not a requirement of other trending trading ranges. Two-way trading is taking place but one side is in slightly more control, accounting for the slope.

多区叠梯(“楼梯”图形)

在一个斜趋势性交易区间的趋势中或在一个宽的斜通道的趋势里,发生推进到新极端价,这个推进过程的形式如下:包含一系列三个或更多的趋势摆动行情,这多个摆动形成较倾斜的交易区间并粗略地被包含在一个通道内。在某区顶(底)起突破发生后,这突破的回撤会少撤退到原交易区间内部少许。这个特点是其他类型的趋势性交易区间不具备的。交易上可以进行双向(就是上卖而下买)的交易,根据俯仰不同而让一边的买卖较占优势(一般整段俯则买空的一边偏优,整段仰则买多的稍优)。

STF See smaller time frame (STF).

STF 参见:较小时间周期框架

strong bulls and bears Institutional traders and their cumulative buying and

selling determine the direction of the market.

强牛市,强熊市(偶尔:强阳线,强阴线)

success Refers to traders achieving their objective. Their profit target was

reached before their protective stop was hit.

Spike

激突行情

韬客社区www.talkfx.co

52楼

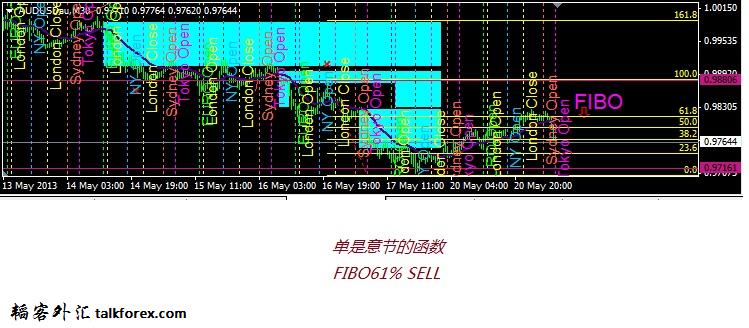

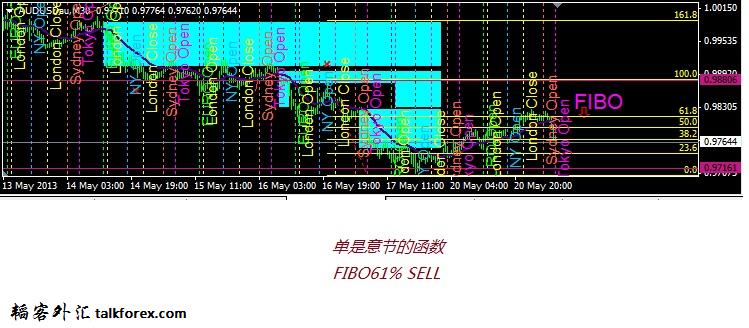

前期AUD和NZD的强下跌,显然是个意节,围绕这个意节可以做后续几单,只是时间不确定,这次除了GBP反弹过头,放弃。

NZD和AUD的解都有利润,而AUD利润多:

FIBOAU-.jpg

FIBOAU-.jpg FIBO05-21-.jpg

FIBO05-21-.jpg

FIBOAU-.jpg

FIBOAU-.jpg FIBO05-21-.jpg

FIBO05-21-.jpg韬客社区www.talkfx.co

53楼

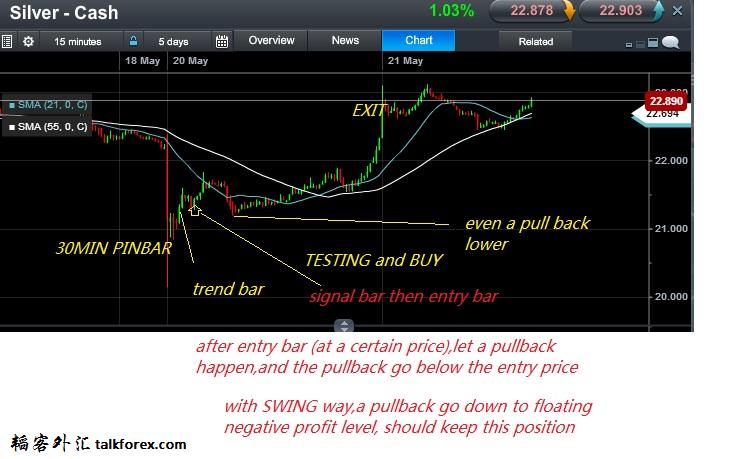

这两天的入场例子如下,过程在:http://www.talkforex.com/thread-220188-1-1.html

图是:

摆动行情对小时间段,也可称为

小波段交易,比头皮交易要利润多。

PA 办法,只有某些是做头皮的,

做SWING 小波段的容易取得比较好的

赢利和风险比,赢利大于风险的情况很多。

ENTRY THEN PUllback-.jpg

ENTRY THEN PUllback-.jpg

ENTRY THEN PUllback-.jpg

ENTRY THEN PUllback-.jpg韬客社区www.talkfx.co

54楼

一个信号图 ,一个作单图

8092-NZD.jpg

8092-NZD.jpg BUYNZDJ5-27.jpg

BUYNZDJ5-27.jpg

8092-NZD.jpg

8092-NZD.jpg BUYNZDJ5-27.jpg

BUYNZDJ5-27.jpg韬客社区www.talkfx.co

55楼

Stair

A push to a new extreme in a trending trading range trend or a broad channel

trend where there is a series of three or more trending swings that resembles a sloping trading range and is roughly contained in a channel. After the breakout, there is a breakout pullback that retraces at least slightly into the prior trading range, which is not a requirement of other trending trading ranges. Two-way trading is taking place but one side is in slightly more control, accounting for the slope.

多区叠梯(“楼梯”图形)

在一个斜趋势性交易区间的趋势中或在一个宽的斜通道的趋势里,发生推进到新极端价,这个推进过程的形式如下:包含一系列三个或更多的趋势摆动行情,这多个摆动形成较倾斜的交易区间并粗略地被包含在一个通道内。在某区顶(底)起突破发生后,这突破的回撤会少撤退到原交易区间内部少许。这个特点是其他类型的趋势性交易区间不具备的。交易上可以进行双向(就是上卖而下买)的交易,根据俯仰不同而让一边的买卖较占优势(一般整段俯则买空的一边偏优,整段仰则买多的稍优)。

STF See smaller time frame (STF).

STF 参见:较小时间周期框架

strong bulls and bears Institutional traders and their cumulative buying and

selling determine the direction of the market.

强牛市,强熊市(偶尔:强阳线,强阴线)

:强(阴)阳线(强市)是机构交易者所为,他们大资金且累积的买多(沽空)决定着市场的方向

success Refers to traders achieving their objective. Their profit target was

reached before their protective stop was hit.

成功(交易判为成功):指交易者达成其目标。或者在市场没到保护止损位前,市场先到达交易者设的目标位。

(Spike 激突行情)

swing A smaller trend that breaks a trend line of any size; the term is used only

when there are at least two on the chart. They can occur within a larger trend or in a sideways market.

摆(摆动行情):指一个小的趋势,其走势突破了某根任何大小级别的趋势线;这个术语只适合图上至少有两次摆动的情况。这些摆动行情出现的地方可以是在更大级别的趋势里,也可出现在横向盘整行情里。

swing high A bar that looks like a spike up on the chart and extends up beyond

the neighboring bars. Its high is at or above that of the bar before it and that of the bar after it.

摆动行情的高(点):在图中,一个棒看起来象尖起的激突行情,且延伸得比附近的棒更远。它的高,既等于或高于该棒之前的棒,也等于或高于该棒之后的一根棒。(为摆顶)

swing high/low Either a swing high or a swing low.

摆的高点/低点(摆动行情的极端点),不是一个摆的高点就是摆的低点

swing low A bar that looks like a spike down on the chart and extends down

beyond the neighboring bars. Its low is at or below that of the bar before it and that of the bar after it.

摆动行情的低点:在图中,一个棒看起来象尖跌的激突行情,且延伸得比附近的棒更远。它的低点,既等于或低于该棒之前的棒,也等于或低于该棒之后的一根棒。(为摆顶)

swing point Either a swing high or a swing low.

摆动行情的端点,一个摆动行情的高点或一个摆的低点

swing trade

For a day trader using a short-term intraday chart like the 5 minute, it is

any trade that lasts longer than a scalp and that the trader will hold through one or more pullbacks. For a trader using higher time frame charts, it is a trade that lasts for hours to several days. Typically, at least part of the trade is held without a profit target, since the trader is hoping for an extended move. The potential reward is usually at least as large as the risk. Small swing trades are called scalps by many traders. In the Emini, when the average range is about 10 to 15 points, a swing trade is usually any trade where the goal is four or more points.

做摆动行情的交易:对利用短期日内图,如5分钟图,的日内交易者,这种摆动交易要比一个头皮所交易花时间要长,并且一直拿着哪怕有一个到几个行情回撤。对于用更高时间周期图的交易者,这种摆动交易要持续数小时甚至数日。典型情况是,至少一部分的交易里交易是不设目标位的,因为交易者交易者期待行情继续延伸移动。这种交易潜在的回报要比风险高(至少不差)。作小形摆动的交易者被很多交易人称为剥头皮者。在EMini 当一个通常平均区间只有10到15点时,一个摆动行情交易者通常取利在四点或四点以上。

test When the market approaches a prior price of significance and can overshoot or undershoot the target. The term failed test is used to mean opposite things by different traders. Most traders believe that if the market then reverses, the test was successful, and if it does not and the move continues beyond the test area, the test failed and a breakout has occurred.three pushes Three swing highs where each swing high is usually higher or three swing lows where each swing low is usually lower. It trades the same as a wedge and should be considered a variant. When it is part of a flag, the move can be mostly horizontal and each push does not have to extend beyond the prior one. For example, in a wedge bull flag or any other type of triangle, the second push down can be at, above, or below the first, and the third push down can be at, above, or below either the second or the first, or both.测试:当市场再次趋近先前的一个显著点(前高、前低,趋势线)就算测试,测试可以穿过了前面显著点--超过性行情,也可以是虽趋近但没到那点的水平--未达行情。tick stocks, it is one penny; for 10-Year U.S. Treasury Note Futures, it is 1/64th of a point; and for Eminis, it is 0.25 points. On tick charts and on time and sales tables, a tick is every trade that takes place no matter the size and even if there is no price change. If you look at a time and sales table, every trade is counted as one tick when TradeStation charting software creates a tick chart.点(点数,成交点),对股票一般每点是一分;10年美债期货 64分之1的基点,对EMini各种电子股指一个点TICK是0.25股指点数。在成交点图(TICK图)和在依时间成交记录表上,一个TICK即成交点,就是一笔交易发生的点而不管这比交易的量大小,即使市场价格并没变化,那原地也是成交点。看依时间成交记录表,当使用TradeStation制图软件产生点数图时,每个交易都记算成一个TICK(点)。点(注:点数和成交点为同一词)tight channel A channel where the trend line and trend channel line are close together, and the pullbacks are small and last for only one to three bars.紧(狭窄)通道:做成通道的两线即趋势线和趋势通道线靠得很近。也就是价格运动的回撤很小且在5分钟图上这种回撤只有很少的棒子,一个到3个棒烛而已。tight trading range A trading range of two or more bars with lots of overlap in the bars and in which most reversals are too small to trade profita** with stop entries. The bulls and bears are in balance.紧(狭窄)交易区间:两个和多个棒组成的交易区间而其中的棒子重叠严重,如果要用STOP单入场在那里做单,多数逆转入场地是刚上上单就被回撤导致不可能得到交易利润。time frame The length of time contained in one bar on the chart (a 5 minute time frame is made of bars that close every five minutes). It can also refer to bars not based on time, such as those based on volume or the number of ticks traded.时间周期框架:一个图表里某棒子包含的时间(5分钟图时间周期框架是用每5分钟就收一次盘的棒烛表示的)。这个词也可用来对不根据时间而做的图里的棒子做描述,比如棒子不按时收而按到了多少成交量就收做一个棒,也可根据成交点TICK的数目,到了一定个数的TICK就收的棒,即使象这样作图的棒子,还是得用 time frame 来描述。tradable A setup that you believe has a reasonable chance of leading to at least a scalper's profit.可交易的:一个进场“就备”模式据信有合理机会至少能得到一个剥头皮者的利润。

trader's equation To take a trade, you must believe that the probability of success times the potential reward is greater than the probability of failure times the risk. You set the reward and risk because the potential reward is the distance to your profit target and the risk is the distance to your stop. The difficulty in solving the equation is assigning a value to the probability, which can never be known with certainty. As a guideline, if you are uncertain, assume that you have a 50 percent chance of winning or losing, and if you are confident, assume that you have a 60 percent chance of winning and a 40 percent chance of losing.

交易者获利期望方程:想进行某交易前,你必须相信该交易至少其潜在回报乘其交易成功率(胜率),大于其潜在风险乘其交易失败率(败率),若前者大才可执行交易。其实你(较易凭点数)设定回报和风险,因为潜在回报就是成交位到获利位的价格距离而潜在风险就是成交位到止损位的距离;解这个方程的困难在于难给那个概率(胜率或败率)赋值,其实确切的值也许永远不知道。作为指引原则,若确实不知道,还是假设50%胜率或败率的为妥。若对某情况你有更高把握,计算就用60%胜而40%为败来计算。(translator's additional chart on 24 May 2013 AUDUSD to show rewarding/risk ratio

前天 13:27 上传下载附件 (54.97 KB) if ratio below 1 still tradable

)trading range The minimum requirement is a single bar with a range that is largely overlapped by the bar before it. It is sideways movement and neither the bull nor the bears are in control, although one side is often stronger. It is often a pullback in a trend where the pullback has lasted long enough to lose most of its certainty. In other words, traders have become uncertain about the direction of the breakout in the short term, and the market will have repeated breakout attempts up and down that will fail. It will usually ultimately break out in the direction of the trend, and is a pullback on a higher time frame chart.

韬客社区www.talkfx.co

56楼

交易区间:成交易区间的最小要求是符合要求的一个单一棒烛,其要求此棒前的那个棒是很大程度上和此根棒价格区是重叠的。交易区间是横盘侧行运动,也许多空某方稍强些,但多头和空头都没能主导行情。交易区间常常是某趋势走势里的一个回撤,而回撤行情足够长以至于表现市场确切方向的迹象而差不多消失而多空不辨了。用另一句话来说就相当于,短期内,若此时来个突破,这时的交易者事先是不能确定方向的。并且市场将行出重复的突破尝试,或向上,或向下但却会突破失败(假突尝试)。当然通常最终还是要突破并顺原势而破出的,在高周期框架图显然是可把此交易区间当主走势的回撤的。trailing a stop As the trade becomes increasingly profitable, traders will often move, or trail, the protective stop to protect more of their open profit. For example, if they are long in a bull trend, every time the market moves to a new high, they **ht raise the protective stop to just below the most recent higher low.

跟踪止损:根据进行中的交易正不断增加获利量的情况,交易者常移动或称跟踪,其对应保护止损单位置,以保护尚在敞口中的浮动利润。例如,在某上升趋势做了多,每当市场移动到一个新高,交易者们可能会抬高保护止损到正好在最新较高低点( Higher LOW)之下。(可参考图)。

trap An entry that immediately reverses to the opposite direction before a scalper's profit target is reached, trapping traders in their new position and ultimately forcing them to cover at a loss. It can also scare traders out of a good trade.

套陷(陷入),在连一个头皮交易者的利润都没机会得到的情况下某个入单立即遇到其逆反的行情。这个起套陷作用的走势,会陷住作了新仓位的交易者,并最终迫使他们带亏平仓。当然,这也能将交易者从一个实际很好的交易里恐吓出来。trapped in a trade A trader with an open loss on a trade that did not result in a scalper's profit, and if there is a pullback beyond the entry or signal bars, the trader will likely exit with a loss.

(套)陷在一个交易中:交易者有个开仓就马上转亏的交易,并导致没机会得到小至一个头皮交易的利润。如果有回撤走势反走超出那进场棒或信号棒的价格区,该交易者很可能带损出场。trapped out of a trade A pullback that scares a trader into exiting a trade, but then the pullback fails. The move quickly resumes in the direction of the trade, making it difficult emotionally for the trader to get back in at the worse price that is now available. The trader will have to chase the market.

因陷亏而出场(的情况):一个回撤让一个交易者惊吓得结束交易离场,但离场后行情却不再走那回撤向——市场快速移动恢复本来进场方向,这时该交易者可得到的价格要差些,真若要在此处重返市场,人就会因情绪问题而倍感困难。这相当于需要追价。

Trend A series of price changes that are either mostly up (a bull trend) or down (a bear

trend). There are three loosely defined smaller versions: swings, legs, and pullbacks. A chart will show only one or two major trends. If there are more, one of the other terms is more appropriate.

趋势:一系列的价格变动或主要往上(上升趋势)、或主要往下(下降趋势),称之。松散些可定义出趋势段的三个更细的版本:摆动行情、肢(LEG)和回撤。一个图将只显示一或两个主要趋势。如果图里趋势很多,则用其他词表达更合适些。

trend bar A bar with a body, which means that the close was above or below the open, indicating that there is at least a minor price movement.

趋势棒:有烛体的棒,也即其收盘或高于开盘、也可或低于开盘,意思是至少有小的价格移动了(不是盘整)。

trend channel line A line in the direction of the trend but drawn on the opposite side of the bars compared to a trend line. A bull trend channel line is above the highs and rising to the right, and a bear trend channel line is below the lows and falling to the right.

趋势通道线:在相对于趋势线的,棒子本身系列的另一边画的方向一样(即和趋势线平行)的画线称之。

trend channel line overshoot One or more bars penetrating a trend channel line.

穿趋势通道线的过头行情:一根和多根棒穿越了一个趋势通道线。

trend channel line undershoot A bar approaches a trend channel line but the market reverses away from the line without reaching or penetrating it.

近趋势通道线的未达行情:一根棒的价格才移近一个趋势通道线 但是在正在达到或穿越该线之前市场价格发生回缩逆离此线。trend from the open A trend that begins at the first or one of the first bars of the day and extends for many bars without a pullback, and the start of the trend remains as one of the extremes of the day for much if not all of the day.从开盘起的趋势:一种其趋势走势从当日图开盘的第一根或开头几根棒就开始的一种趋势走法,而且很多棒都是没回撤的,这样,虽不是全天但至少一日之大多数时间内,这个趋势起点就是该日价格极端点之一。

trending closes Three or more bars where the closes are trending. In a bull trend, each close is above the prior close, and in a bear trend, each close is lower. If the pattern extends for many bars, there can be one or two bars where the closes are not trending.

呈趋势性的收盘(组段):呈趋势性的收盘组行情里的那三个或多个棒可称之。在上升趋势里,有此性质的段内的每个棒的收盘价要比前一个棒的收盘价高些;而在下降趋势里,段内的每个棒其收盘价比前棒低些。如果某趋势性图形模式延伸了很多根棒,包含的一个或两个棒可以不完全符合呈趋势性收盘的特点。

trending highs or lows The same as trending closes except based on the highs or lows of the bars.

呈趋势性排的高点(最高价)或低点(最低价):如上呈趋势性收盘价一样的术语说法,只是现在不根据收盘价而根据棒的高点(最高价)和低点(最低价)。《注:即烛的OCHL四价标图的 H和L 也呈趋势性排》

trending swings Three or more swings where the swing highs and lows are both higher than the prior swing highs and lows (trending bull swings), or both lower

(trending bear swings).

呈趋势性的摆动行情组:三个或更多个摆动行情,(趋势性看涨的摆动行情组)其摆动之顶和底均高于前一摆动行情的顶和底,或(趋势性看跌摆动行情组)摆动顶(底)要低于先前摆之顶(底)。

trending trading ranges Two or more trading ranges sep***ted by a breakout.

呈趋势性的交易区间组:两个或多个交易区间被一个(上或下的)突破分隔。(注:如果每个突破都能表达成H4阳强烛,则这种图马上染色成本坛特说的唯象区图景)trend line A line drawn in the direction of the trend; it is sloped up and is below the bars in a bull trend, and it is sloped down and is above the bars in a bear trend. Most often, it is constructed from either swing highs or swing lows but can be based on linear regression or just a best fit (eyeballing).

趋势线::按趋势之向画的线称之;在牛势中此线要画在棒底(或棒下)而呈向右延伸的升仰角,而在熊势中此线要画在棒顶(或棒上方)而呈向右延伸的降俯角。大多数情况下,是由一些摆动行情的顶或底直接构画,当然也可以取用回归拟算或眼球目视看是否合适来构画。

trend reversal A trend change from up to down or down to up, or from a trend to a trading range.

趋势逆转(反转):一指趋势从向下变向上或趋势从上涨变下跌,二指从趋势市变成交易区间行情。

20 moving average gap bars Twenty or more consecutive bars that have not touched the moving average. Once the market finally touches the moving average, it usually creates a setup for a test of the trend's extreme.

20指均线缺口棒:已有20根或更多根连续的棒子没触及20均线。一旦市场价格终于触及该均线后,往往能形成一个进场“就备”模式而去做对趋势极端位的测试运行(注:就是价格从低飘起然后跌下就是极端低,向下走是在测试,测试后往往受支撑折返故为买入SETUP)。

undershoot The market approaches but does not reach a prior price of significance like a swing point or a trend line.

未达行情:市场价在接近却没全达到前期价格显著处,(象)一个摆动行情的端点或一根趋势线等。

unlikely At most 40 percent certain.

不太可能:至多只有40%的确定性。

unreasonable A setup with an unfavorable trader's equation.不(算)合理的:一个进场“就备”模式若做交易者获利期望方程评估是不好的,无利的。

usually At least 60 percent certain.通常: 至少60%的确定性用usually.vacuum A buy vacuum occurs when the strong bears believe that the price will soon be higher so they wait to short until it reaches some magnet above the market.The result is that there is a vacuum that sucks the market quickly up to the magnet in the form of one or more bull trend bars. Once there, the strong bears sell aggressively and turn the market down. A sell vacuum occurs when the strong bulls believe that the market will soon be lower so they wait to buy until it falls to some magnet below the market. The result is that there is a vacuum that sucks the market down quickly to the magnet in the form of one or more bear trend bars. Once there, strong bulls buy aggressively and turn the market back up.

吸真空(器)形:当强卖方在某段跌发生后,相信价格很快会返高,则他们的行为是暂等待价格到达上方某均线(20EMA)将呈“均线磁棒”(棒均合粘样行情)处,然后再卖出。所以这机会是可以买入的:作多的吸真空形。如此导致的结果是

有一个吸真空(器)把价格快速吸到行情的“均线磁棒”(棒均合粘样行情)处,并且行情呈现出一个或多个上升趋势棒。接着一旦价格到了那里,从这里强卖方就进攻性地沽空并让价格跌落(注:超短的买入时机,不出场马上被套或损)。

另外,当强买方在某段涨发生后,相信价格很快会返低,则他们的行为是暂等待价格到达下方某均线(20EMA)将呈“均线磁棒”(棒均合粘样行情),然后再买入。所以这机会是可以卖空的:作空的吸真空形。如此导致的结果是

有一个吸真空(器)把价格快速吸到行情的“均线磁棒”(棒均合粘样行情)处,并且行情呈现出一个或多个下降趋势棒。接着一旦价格到了那里,从这里强卖方就进攻性地买入并让价格升起。wedge Traditionally, a three-push move with each push extending further and the trend line and trend channel line at least minimally convergent, creating a rising or descending triangle with a wedge shape. For a trader, the wedge shape increases the chances of a successful trade, but any three-push pattern trades like a wedge and can be considered one. A wedge can be a reversal pattern or a pullback in a trend (a bull or bear flag).

楔形:传统定义里,若分段行情每个推动延伸更远,则这个三推形的行情移动就是楔形,且产生上升或下降的如楔子状的三角形。对某交易者而言,虽然这种楔形增加了其变为成功交易的机会,但是任何形状象楔形的三推形也都可考虑做单。另外,一个楔形可以是逆转模式的也可以是趋势里暂回撤模式的(==涨旗形或看跌旗形)。

wedge flag A wedge-shaped or three-push pullback in a trend, such as a high 3 in a bull trend (a type of bull flag) or a low 3 in a bear trend (a type of bear flag). Since it is a with-trend setup, enter on the first signal.

楔形状旗形:这指趋势里有楔形的回撤或三推形的回撤的旗形,例如H3=调整中第三次上突在一个上升趋势里(算看涨旗形的一类),或L3=调整中第三次下突在一个下降趋势里(算看跌旗形的一类)。又因为这是顺着势的进场“就备”模式,可在第一次信号进场。

wedge reversal A wedge that is reversing a bull trend into a bear trend or a bear trend into a bull trend. Since it is countertrend, unless it is very strong, it is better to take a second signal. For example, if there is a bear trend and then a descending wedge, wait for a breakout above this potential wedge bottom and then try to buy a pullback to a higher low.

楔形反转(逆转):一个楔形,其逆转上升趋势为下降趋势,反之也然。因为这算是逆势的,所以除非特别前迹象逆转,否则回避不用而等第二次信号进单为妥。例如,市场有个下跌趋势,接着出现上升楔形行情,最好等待市场在这个潜在楔形底的上方突破,而且还要等突破后的紧接回撤,在回撤跌向那更高的低点时才买入。

with trend Refers to a trade or a setup that is in the direction of the prevailing trend. In general, the direction of the most recent 5 minute chart signal should be assumed to be the trend's direction. Also, if most of the past 10 or 20 bars are above the moving average, trend setups and trades are likely on the buy side.

顺着势:指某交易或某个进场“就备”模式和当前主流趋势方向一致。一般地,最近的 5分钟图表信号的方向应当假定为趋势方向,如果刚过去的10到20个棒基本在20均线之上,则趋势进场“就备”模式或交易多应那些做多买入的单。

Book 2: Trading Price Action Trading Ranges: Technical Analysis of Price Charts Bar by Bar for the Serious Trader

Breakouts. These are transitions from trading ranges into trends.

突破

Gaps. Breakouts often create several types of intraday gaps that can be helpful to traders, but these gaps are evident only if you use a broad definition.

缺口

Magnets, support, and resistance. Once the market breaks out and begins its move, it is often drawn to certain prices, and these magnets often set up reversals.

"均线磁棒"(支撑阻力作用行情)、均粘磁域:一旦市场突破并开始移动,它往往会回缩到一定价位,而这些均线磁棒(支撑阻力作用行情)常当反转进场“就备”模式来用。

Pullbacks. These are transitions from trends to temporary trading ranges.

回撤website at www.brookspriceaction.com,

韬客社区www.talkfx.co

57楼

常见PA入场点分析:可以有多个理由让您入场,比如NZDJ的是三个入场但是理由都不同,唯一同的是,往上走-就想着往上跟。

这是共同点,另外是日本元的iOi的图,i 是inside Bar 就是短的,O是outside bar 就是大阳线。

JPy285.jpg

JPy285.jpg NZDJ RESL28.jpg

NZDJ RESL28.jpg NZDJ 5-27.jpg

NZDJ 5-27.jpg BUYNZDJ5-27.jpg

BUYNZDJ5-27.jpg

JPy285.jpg

JPy285.jpg NZDJ RESL28.jpg

NZDJ RESL28.jpg NZDJ 5-27.jpg

NZDJ 5-27.jpg BUYNZDJ5-27.jpg

BUYNZDJ5-27.jpg韬客社区www.talkfx.co

58楼

本帖最后由 精工美元 于 2013-5-28 19:47 编辑

一个实例,和几个发现进场模式的办法:

1

2

narrow-range-chart-4 88.jpg

narrow-range-chart-4 88.jpg gap-and-trap-6 88.jpg

gap-and-trap-6 88.jpg candlestick-lower-shadowrej or shadw88.jpg

candlestick-lower-shadowrej or shadw88.jpg candle-penetration pentr50in88.jpg

candle-penetration pentr50in88.jpg EUR ENTRY28-29.jpg

EUR ENTRY28-29.jpg

narrow-range-chart-4 88.jpg

narrow-range-chart-4 88.jpg gap-and-trap-6 88.jpg

gap-and-trap-6 88.jpg candlestick-lower-shadowrej or shadw88.jpg

candlestick-lower-shadowrej or shadw88.jpg candle-penetration pentr50in88.jpg

candle-penetration pentr50in88.jpg EUR ENTRY28-29.jpg

EUR ENTRY28-29.jpg韬客社区www.talkfx.co

59楼

若只看则还有:

price-action-sup-3 88.jpg

price-action-sup-3 88.jpg narrow-range-chart-4 88.jpg

narrow-range-chart-4 88.jpg

price-action-sup-3 88.jpg

price-action-sup-3 88.jpg narrow-range-chart-4 88.jpg

narrow-range-chart-4 88.jpg60楼

接欧元5月29讨论,从帖子 http://www.talkforex.com/thread-220632-1-1.html

继续,常见变换和ii突破

ABCABC-返回趋势段:

rej-eur 3pushes.jpg

rej-eur 3pushes.jpg

rej-eur 3pushes.jpg

rej-eur 3pushes.jpg韬客社区www.talkfx.co

2013PIC-.gif

2013PIC-.gif