唯象区位流:价为PA,PRICE ACTION 新方法

21楼 电梯直达

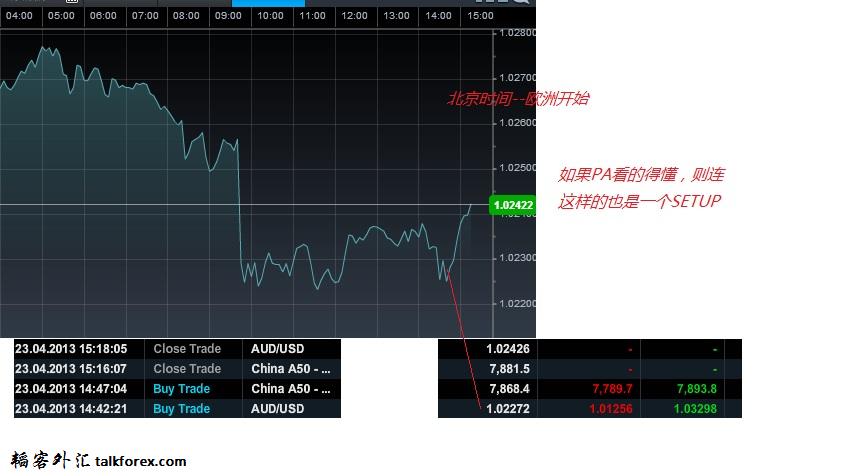

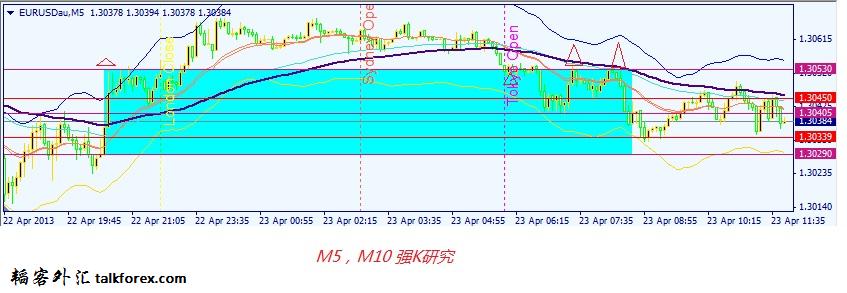

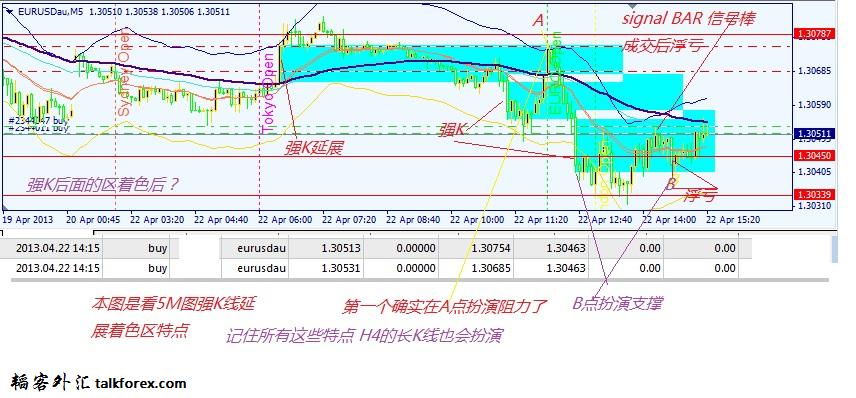

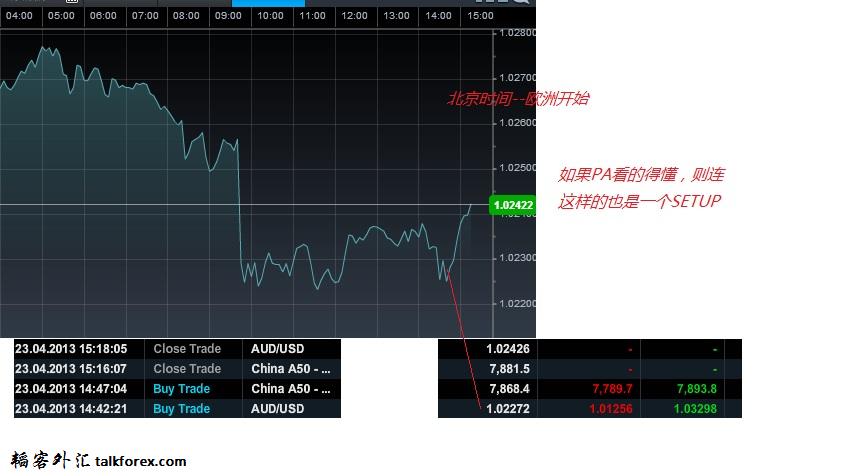

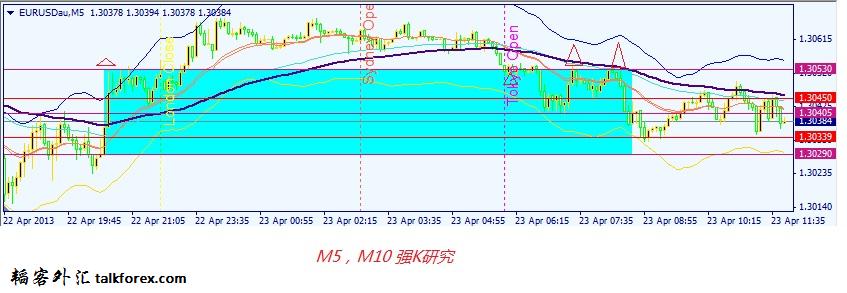

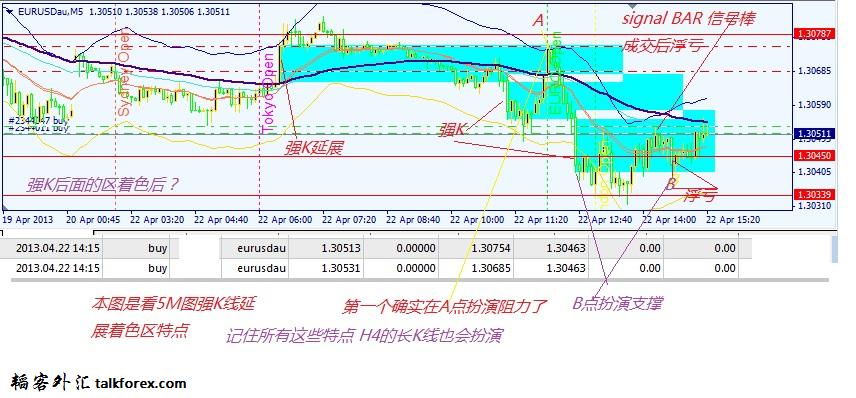

21楼 电梯直达四个图 欧元的转折V型宣告,任何SETUP都可能对错逆变:

SETUP as 4-23-.jpg

SETUP as 4-23-.jpg Turn POINT23 EUR-.jpg

Turn POINT23 EUR-.jpg QKM5 M10-.jpg

QKM5 M10-.jpg QKLINE-.jpg

QKLINE-.jpg

SETUP as 4-23-.jpg

SETUP as 4-23-.jpg Turn POINT23 EUR-.jpg

Turn POINT23 EUR-.jpg QKM5 M10-.jpg

QKM5 M10-.jpg QKLINE-.jpg

QKLINE-.jpg22楼

做单很可能是: 凡是已“就备”的就该入场,凡是不就备(NOT A SETUP)的,就不入场。

SETUP也可翻译成 进场“就备”。

PA的活,在就备=SETUP 处入场,进单条件就是:一定不在轨了。

比如平台盘是一种轨,颈线是一种“单轨型要点”,现在假设行情运行是趋势段,还正在陡斜地跌,这时,PA交易者在没破某形态时也不能进单,因为在跌呢,有空单就留仓。一波升趋势,在变(轨)的时候,比如盘整了(这样就是变),或平走,

或逆跌回(这时3BAR有用),这样就是说,趋势在走,交易者需要不动。趋势轨道变了,人才能去动。

当趋势逆反时。正好

可能符合极端点或结构转折点的要求,升趋势就要在顶极端作反空了。这就是PA必做的一些事。

接续这种纯文字,还要说明PA这种遇到"不在轨",才动手的方法是有优势的,为什么呢?

因为任何行情必然镶嵌了“中继形态或某型盘整”,而这个区RANGE必有上边和下边。

如果要剥头皮,这样已经可以获利几个点了。

但是价值更重要的是某区边被跌破,后面也许是100,或200点或更多,而突破入场时都能打单入场,这后面的

下平台后的价格单向飞奔段,就是奖励的大段价差利润。所以

入场后不轻易出场,就可能捞很多点。这是PA 交易员的另一个优势。

也是趋势赢利关键。

当然,如果都是真突破。则应该很多赢利的,所以假突破等“撩琴”才是它的难点。

但老 AL 说他有法子。比如2次尝试规则,FFF,failed final flag=也是结构端点?

23楼

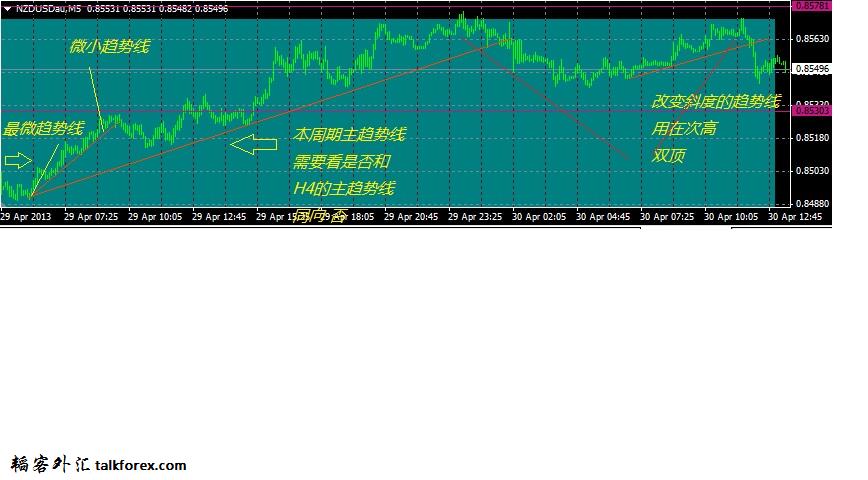

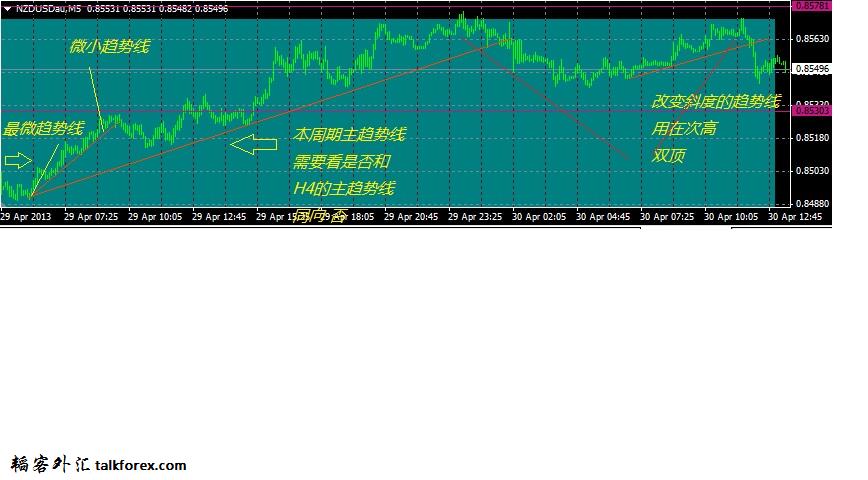

MICROtrend线 被逆向趋势打破时,行情是逆转市(还是)结果继续如中继?

凡是5M的旗形等,盘整CORRECTION类都要到打破它,交易者才动手。

5M PA要点

中国人写字讲究 点横竖撇捺勾,和空间协调。PA操盘按中式说法就是“三主律,和几声是非撩琴”

三主律在5分钟图上是:寻轨、在轨不动、不在轨或许动。

“是非”就是 真突还是假突,上突不成则下面出盘整区就是真的,这些内容。

做5M图看形态和画线的PA的人其实只有一个中心工作:三个词组:

这个本楼主比 Al 总结得好:

PA 其实就是:寻轨,在轨不动,不在轨或许动手

的一套办法。

如果在盘整,比如平台窄盘,不打破则其在轨,

盘整被打破即是动手的时候。

再加关键动作的是与非的观点, 比如突破,不成 则假突破,

向下走买不成则区间穿上。

韬客社区www.talkfx.co

24楼

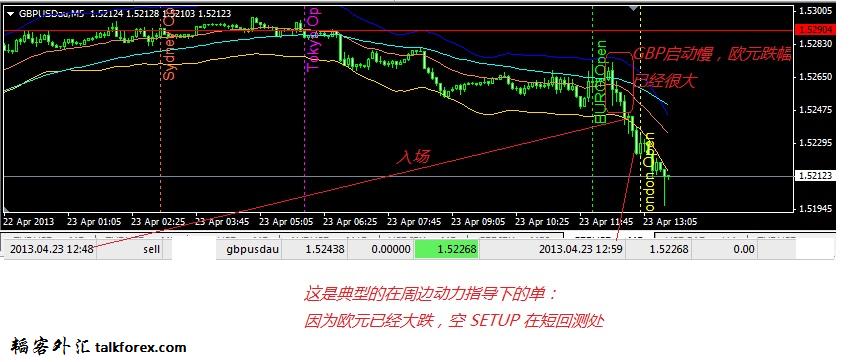

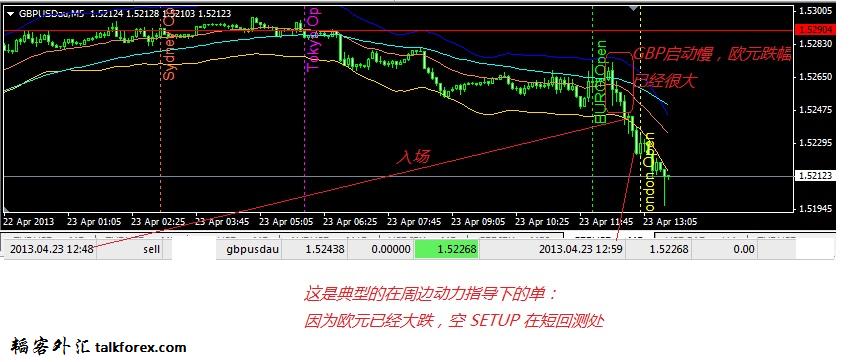

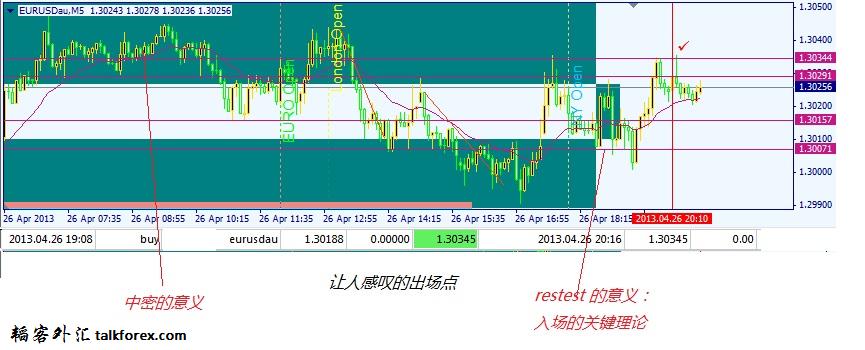

2013-4-23下午,跌是欧元这个周边跌幅大,所以根据周边动力学作单:

图为卖出:GBP 5 M PA进出场点:

123-4GB.jpg

123-4GB.jpg SELL GBP4-23-.jpg

SELL GBP4-23-.jpg

123-4GB.jpg

123-4GB.jpg SELL GBP4-23-.jpg

SELL GBP4-23-.jpg韬客社区www.talkfx.co

25楼

大概的理论 和粗略的几个例子已经完毕,

下面集中精力看唯象区位流的PA单法的,入场根据。先不管根据这些,

真入场后是亏还是赢,而是看凭什么入单。我们在前一楼是说根据欧元周边,

而标准PA只能根据GBP跌破了,然后稍微回涨一点点时( 叫retest回测),就空。

这是大动作,见回调就空,因为是欧元的行情,做空不会选AUD的,结果AUD基本没动。

所以如果只讲回调进单,则标准PA的根据就是这个。象这套看法是成体系的,

需要一个学习而上手的过程

26楼

理论比较重要的有 否定之否定,Failed failure,失败的什么,,

还有,第二次如此,

Two attempts rule两次尝试规则:One key observation of price action traders is that the market often revisits price levels where it reversed or consolidated. If the market

PA交易人之要见之一是价格常常再次来到《《那些发生转折反向的端点附近或盘整区之边》》。(注:上次没突破区,这次会突破吗,人们望着基本不动)

reverses at a certain level, then on returning to that level, the trader expects the market to either carry on past the reversal point or to reverse again. The trader takes no action until the market has done one or the other.

前有市场在价格XXX处反转了,这时若价格回到此处,交易者期望或料定市场走势会续走而越过那个价(破XXX)或选再次折返的路。交易者要等行情自己清晰选择,不选明而一直按兵不动。

It is considered to bring higher probability trade entries, once this point has passed and the market is either continuing or reversing again.

做了这事后,才跟向(不管是续向还好反向)的,其预后良好的概率要高很多 The traders do not take the first opportunity but rather wait for a second entry to make their trade.作为有经验的,会在第一次试向端点的时候不动,在第二次才动手:做单要等第二次机会!

下面就 TAR:Two attempts rule两次尝试规则举个例子:

For instance the second attempt by bears to force the market down to new lows

represents, if it fails, a double bottom and the point at which many bears will

abandon their bearish opinions and start buying, joining the bulls and

generating a strong move upwards.[14] 例如常见

双底,就是一次下探不干,非等第二的底,才捞多。

Also as an example, after a break-out of a trading range or a trend line, the

market may return to the level of the break-out and then instead of rejoining

the trading range or the trend, will reverse and continue the break-out. This is

also known as 'confirmation'.另外就是突破趋势线或破区间后,市场也有一个动作,

就是会回到原来突破地,如果消息稍强劲,则可能只是测到半途就可以了

。见图解5和6 看回测,

这个原因是,强消息让人们挂高一点单

一遍提前成交做多

再有就是三次有变,比如三PUSHES 变盘。

还有就是完形心理,形态完形后重变,

等节奏预期等等

韬客社区www.talkfx.co

发表于:2013-04-23 17:39只看该作者

27楼

你的帖子很有启发意义。很有启发意义。很有启发意义。 我慢慢消化

韬客社区www.talkfx.co

发表于:2013-04-24 04:42只看该作者

28楼

看不懂啊,问一下楼主,这个方法你理解了吗?用于实战了吗?效果如何?可以把你的理解用大白话结合图表教一教像我这种什么也看不懂的新手吗?

韬客社区www.talkfx.co

29楼

实际下单 思路也许不用这个,但是有这个超武器在身边,要自信得多,因为所谓价位PA的办法,先是 老外流行,后来有人学了,

到中文论坛来,炫耀战绩,就是说凭盘感好,做短线或超短,结果,一大列单子竟然是稳健赢利状态,这类短线高手,是真战绩。

但是最后,还是被他们的同行把消息捅了出来。说战绩是真的,但是单子下得有一个说法,就是PA(PRICE ACTION)的招数。

结果自然有人愿意i了解究竟。这个是插话。

在说回来:实际下单 思路也许不用这个

比如下面的黄金是根据这段道指跌黄金跌的基本套路来走,昨日美国开盘,道指

涨了不少,看情况就作了买多的黄金单。这个单就是这个理由,没有什么PA在里面。

如图:

GOLD23-24.jpg

GOLD23-24.jpg

GOLD23-24.jpg

GOLD23-24.jpg31楼

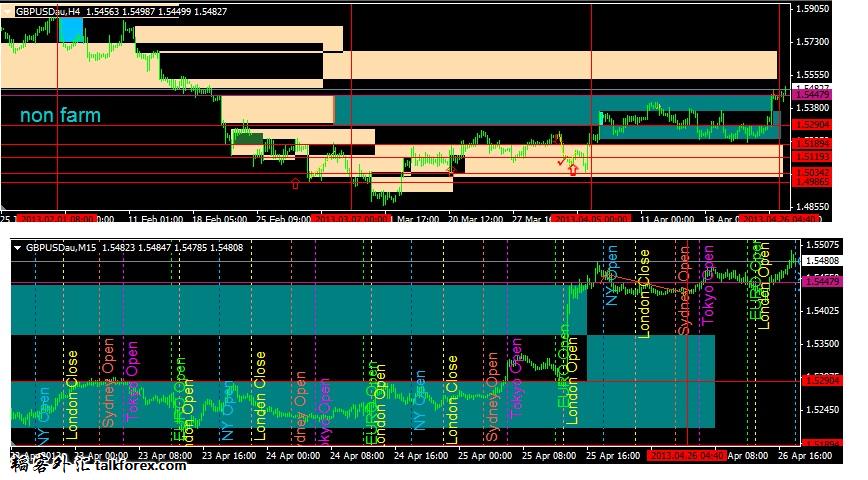

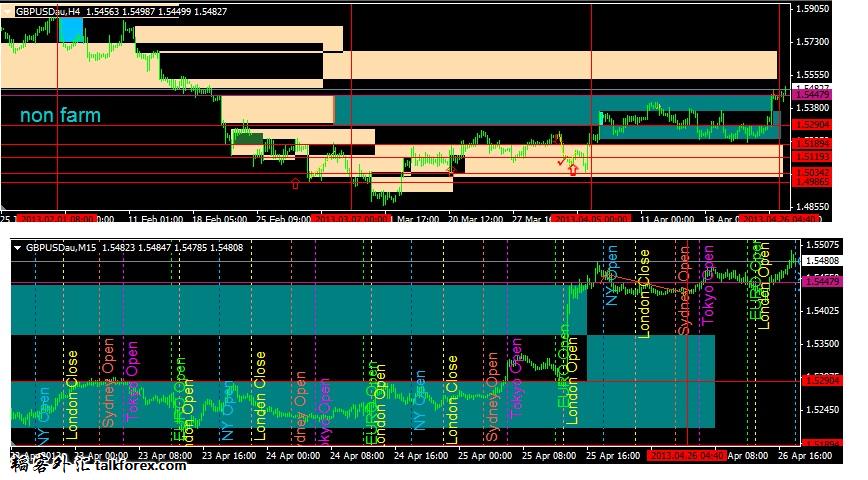

一波有特质的行情,符合某些条件且看作主力的一个的自意而为就是 一个“意节”,GBP应该主力参与了昨日的继续向上行情。

所以因为有100多点,如何都是一个 意节,更因为操作哲学是根据:单是意节的函数。

见CLIMAX 具备,高潮过后面临选择,而恰恰这时EUR较大幅跌,所以直接下了空,这是所谓周边动力学的搞法。

之后看15M图有典型次高假上冲,变PINBAR 假鼻子图形,过后就是FAKEY,凭STOPLOSS止损抛空。

这个就是入场的三个图(一般花半天时间在网上搜索就能知道这些,懂英语的更容易得到很多资料,所以术语就不太ABC,抱歉)。

25日:

5MGBPF1-.jpg

5MGBPF1-.jpg 5MGBP3YJ-.jpg

5MGBP3YJ-.jpg 5-15GB-.jpg

5-15GB-.jpg

5MGBPF1-.jpg

5MGBPF1-.jpg 5MGBP3YJ-.jpg

5MGBP3YJ-.jpg 5-15GB-.jpg

5-15GB-.jpg韬客社区www.talkfx.co

32楼

本帖最后由 精工美元 于 2013-4-26 18:01 编辑

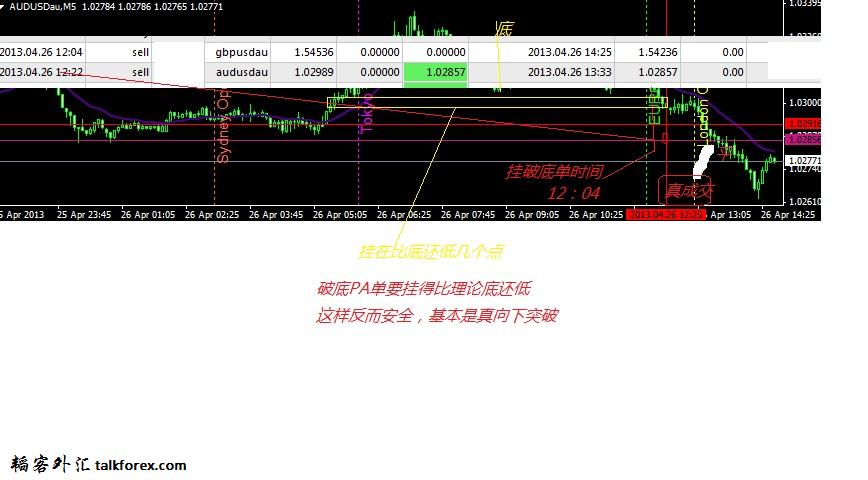

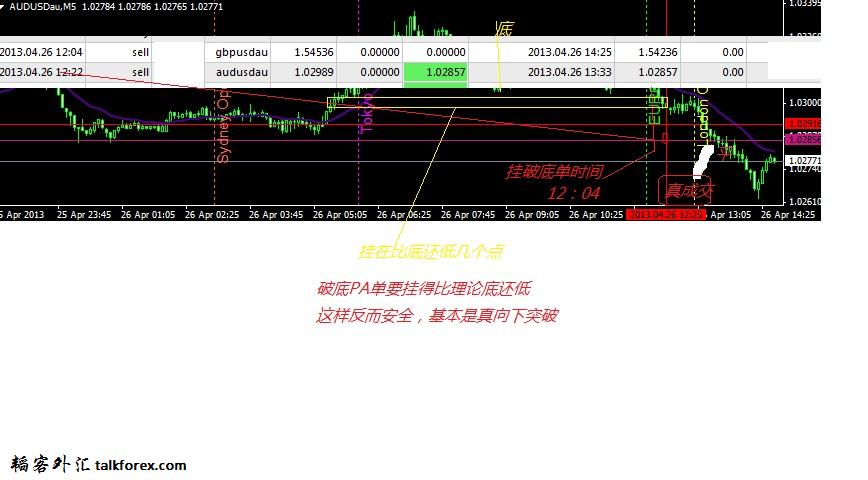

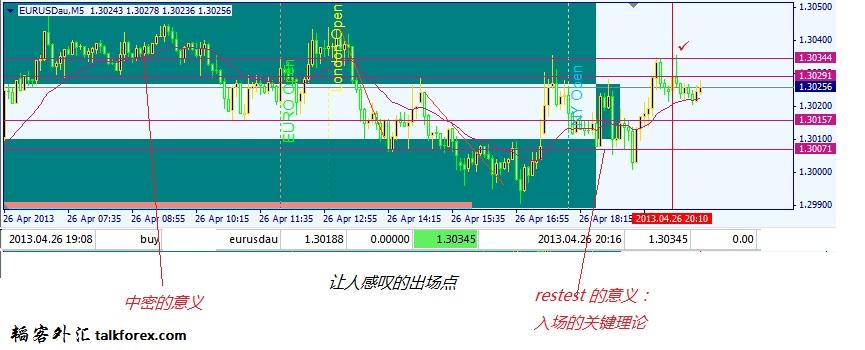

做单往往是,在如果 其他判据来不及,可以直接按 其他判据做,这里欧元是如此,也有欧元对照PA

的地方;

另外AUD则是用挂单,单在二十多分钟真破底才成交,宁可多低几个点(确认真突破):例子图

附上GBP单(因为时间参照)

26APr EUr-.jpg

26APr EUr-.jpg 26APr AU-.jpg

26APr AU-.jpg

26APr EUr-.jpg

26APr EUr-.jpg 26APr AU-.jpg

26APr AU-.jpg韬客社区www.talkfx.co

33楼

本帖最后由 精工美元 于 2013-4-27 00:00 编辑

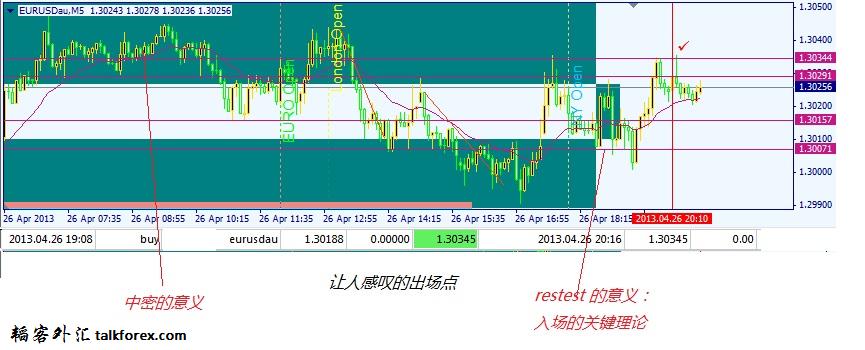

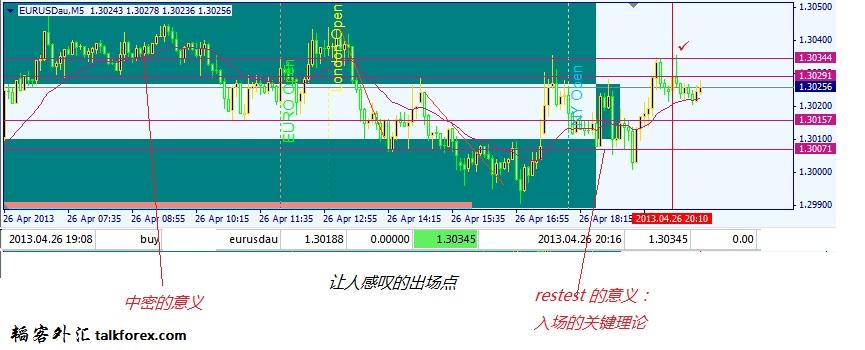

令人惊叹的出场点,这里入场有奥妙,出场更妙欧元

4-26EU-3 EXIT-.jpg

4-26EU-3 EXIT-.jpg 4-26EU-2---.jpg

4-26EU-2---.jpg 4-26EU---.jpg

4-26EU---.jpg GBP26-42013--.jpg

GBP26-42013--.jpg

4-26EU-3 EXIT-.jpg

4-26EU-3 EXIT-.jpg 4-26EU-2---.jpg

4-26EU-2---.jpg 4-26EU---.jpg

4-26EU---.jpg GBP26-42013--.jpg

GBP26-42013--.jpg韬客社区www.talkfx.co

34楼

本帖最后由 精工美元 于 2013-4-27 06:20 编辑

26日楼上是说低动力周边,1 回测和1,3整数位等重要;

这楼是银进场条件,但出场错失

4-26EU-3 EXIT-.jpg

4-26EU-3 EXIT-.jpg 4-26SILV-.jpg

4-26SILV-.jpg

4-26EU-3 EXIT-.jpg

4-26EU-3 EXIT-.jpg 4-26SILV-.jpg

4-26SILV-.jpg韬客社区www.talkfx.co

35楼

基本举了例子,是如何用的,

所以,以后要休息了

韬客社区www.talkfx.co

36楼

doji A candle with a small body or no body at all. On a 5 minute chart, the bodywould be only one or two ticks; but on a daily chart, the body **ht be 10 or moreticks and still appear almost nonexistent. Neither the bulls nor the bears controlthe bar. All bars are either trend bars or nontrend bars, and those nontrend barsare called dojis.类十字线:指那些烛体小甚至没烛体只有影线的蜡烛图。在5分钟图,烛体至于一或两个点;而日线烛体也不过占10或多些点的幅度,在日线级别看还是“似乎没有烛体”的。类十字线表示多头和空头都不控制占优。另外本书所提的一切棒烛,只有两分,或属于趋势棒,或属于非趋势棒。这些非趋势棒,又可成类十字线(十字 DOJI)。double bottom A chart formation in which the low of the current bar is about thesame as the low of a prior swing low. That prior low can be just one bar earlier or 20or more bars earlier. It does not have to be at the low of the day, and it commonlyforms in bull flags (a double bottom bull flag).双底:图形态的一种,其当前棒的底几乎和前面摆低底的价格相同,这个前低可以是发生在本棒之前的一个棒(紧邻)或20甚至更多根棒之前的棒。这低点不必是全日的最低,这底通常形成于看涨旗形之中(一种包含双底的看涨旗形)double bottom bull flag A pause or bull flag in a bull trend that has two spikesdown to around the same price and then reverses back into a bull trend.

带双底的看涨旗形:在一个含有两段下降到几乎同水平价的“数棒连跌小走势段”的,一个上升趋势中的暂停或看涨旗形, 二次落底之后会逆转而回上升趋势。double bottom pullback A buy setup composed of a double bottom followed bya deep pullback that forms a higher low.

双底回撤:一种买入进场“就备”模式,包含一个双底紧接一较深回撤,并跌成

一较高的低点。

double top A chart formation in which the high of the current bar is about thesame as the high of a prior swing high. That prior high can be just one bar earlieror 20 or more bars earlier. It does not have to be at the high of the day, and itcommonly forms in bear flags (a double top bear flag).双顶:图形的一种,其当前棒的顶几乎和前面摆高顶的价格相同,这个前高可以是发生在本棒之前的一个棒(紧邻)或20甚至更多根棒之前的棒。这高点不必是全日的最高,这顶通常形成于看跌旗形之中(一种包含双底的看涨旗形)double top bear flag A pause or bear flag in a bear trend that has two spikes upto around the same price and then reverses back into a bear trend.带双顶看跌旗形:在一个含有两段上升到几乎同水平价的“突进小走势段”的,一个下降趋势中的暂停或看跌旗形, 二次升高之后会逆转而回下降趋势。double top pullback A sell setup composed of a double top followed by a deeppullback that forms a lower high.双顶回撤:一种卖出进场“就备”模式,包含一个双顶紧接一较深向上回撤,并跌成一较低的高点。early longs Traders who buy as a bull signal bar is forming rather than waitingfor it to close and then entering on a buy stop at one tick above its high.提早作多:交易者不是等当前棒收盘,并在棒子的顶上设挂STOP买入单买在比此棒高点还高一个点的地方。而是在当前看涨棒子没全形成时就买进。early shorts Traders who sell as a bear signal bar is forming rather than waitingfor it to close and then entering on a sell stop at one tick below its low.提早作空:交易者不是等当前棒收盘,并在棒子的底上设挂STOP沽空单卖在比此棒低点还低一个点的地方。而是在当前看跌棒子没全形成时就卖出。edge A setup with a positive trader’s equation. The trader has a mathematicaladvantage if he trades the setup. Edges are always small and fleeting because theyneed someone on the other side, and the market is filled with smart traders whowon’t allow an edge to be big and persistent.市赠机会(无忧优势):具有正交易者方程性质的入场模式。如果他交易这个进场“就备”模式,则该交易者就有数学优势。市赠机会的获利值都很小且转身即逝 。因为它们需要交易对手,而市场到处都是智能的交易人或机构,他们不会让市赠机会太大并老呆在那里。EMA See exponential moving average (EMA).EMA 指数平均移动线(指均)entry bar The bar during which a trade is entered.入场棒(进场线),这就是成交发生的棒exponential moving average (EMA) The charts in these books use a 20-barexponential moving average, but any moving average can be useful.指数均线(EMA)本书用的指20指均线,但是,任何时间的均线其实都有用。fade To place a trade in the opposite direction of the trend (for example, sellinga bull breakout that you expect to fail and reverse downward).“扳衰单”(做“扳衰单”的动作:动词):入场交易的方向和趋势方向相反(例如,当你预料一个上升突破要失败并逆转而下跌,则用本做方式卖出单。)failed failure A failure that fails, resuming in the direction of the original breakout,and therefore a breakout pullback. Since it is a second signal, it is morereliable. For example, if there is a breakout above a trading range and the bar afterthe breakout is a bear reversal bar, if the market trades below that bar, the breakouthas failed. If the market then trades above the high of a prior bar within the nextfew bars, the failed breakout has failed and now the breakout is resuming. Thismeans that the failed breakout became a small bull flag and just a pullback fromthe breakout.

否否之复(失败的失败),在失败的一个失败,正恢复原突破方向的运动,

因之整个能构成一个突破回撤运动。又因为这明显是第二次信号,所以要更可靠。

例如,在交易区间的上方发生一个突破,在突破后接续的看跌逆转棒(往下行),

而如果行情一直停留低位而比那个棒低,则显得突破是失败的。这时如果市场在下几个棒之内升起到高于前棒并留在高处交易着。这就是一个原失败的突破算是

不成立了,接着现在原向突破恢复了。这也就是说那失败的突破渐变成小的

看涨旗形,并且这实在只不过是突破后的一个回撤。

failure (a failed move) A move where the protective stop is hit before a

scalper’s profit is secured or before the trader’s objective is reached, usually leading

to a move in the opposite direction as trapped traders are forced to exit at a loss.

Currently, a scalper’s target in the Emini of four ticks usually requires a six-tick

move, and a target in the QQQQ of 10 ticks usually requires a move of 12 cents.

false Failed, failure.

five-tick failure A trade in the Emini that reaches five ticks beyond the signal

bar and then reverses. For example, a breakout of a bull flag runs five ticks, and

once the bar closes, the next bar has a low that is lower. Most limit orders to take

a one-point profit would fail to get filled since a move usually has to go one tick

beyond the order before it is filled. It is often a setup for a trade in the opposite

direction.

flat Refers to a trader who is not currently holding any positions.

follow-through After the initial move, like a breakout, it is one or more bars that

extend the move. Traders like to see follow-through on the next bar and on the

several bars after that, hoping for a trend where they stand to make more profit.

follow-through bar A bar that creates follow-through after the entry bar; it is

usually the next bar but sometimes forms a couple of bars later.

fractal Every pattern is a fractal of a pattern on a higher time frame chart. This

means that every pattern is a micro pattern on a higher time frame and every micro

pattern is a standard pattern on a smaller time frame.

gap A space between any two price bars on the chart. An opening gap is a common

occurrence and is present if the open of the first bar of today is beyond the

high or low of the prior bar (the last bar of yesterday) or of the entire day. A moving

average gap is present when the low of a bar is above a flat or falling moving

average, or the high of a bar is below a flat or rising moving average. Traditional

gaps (breakout, measuring, and exhaustion) on daily charts have intraday equivalents

in the form of various trend bars.

gap bar See moving average gap bar.

gap reversal A formation in which the current bar extends one tick beyond the

prior bar back into the gap. For example, if there is a gap up open and the second

bar of the day trades one tick below the low of the first bar, this is a gap reversal.

LIST OF TERMS USED IN THIS BOOK xvii

HFT See high-frequency trading (HFT).

higher high A swing high that is higher than a previous swing high.

higher low A swing low that is higher than a previous swing low.

higher time frame (HTF) A chart covering the same amount of time as the

current chart, but having fewer bars. For example, compared to the day session

5 minute Emini chart on an average day, examples of higher time frame charts

include a 15 minute chart, a tick chart with 25,000 ticks per bar, and a volume chart

with 100,000 contracts per bar (each of these charts usually has fewer than 30 bars

on an average day, compared to the 81 bars on the 5 minute chart).

high-frequency trading (HFT) Also known as algorithmic trading or black box

trading, it is a type of program trading where firms place millions of orders a day

in thousands of stocks to scalp profits as small as a penny, and the trading is based

on statistical analysis rather than fundamentals.

high/low 1 or 2 Either a high 1 or 2 or a low 1 or 2.

high 1, 2, 3, or 4 A high 1 is a bar with a high above the prior bar in a bull flag or

near the bottom of a trading range. If there is then a bar with a lower high (it can

occur one or several bars later), the next bar in this correction whose high is above

the prior bar’s high is a high 2. Third and fourth occurrences are a high 3 and 4. A

high 3 is a wedge bull flag variant.

HTF See higher time frame (HTF).

ii Consecutive inside bars, where the second is inside the first. At the end of a

leg, it is a breakout mode setup and can become a flag or a reversal setup. A less

reliable version is a “bodies-only ii,” where you ignore the tails. Here, the second

body is inside the first body, which is inside the body before it.

iii Three inside bars in a row, and a somewhat more reliable pattern than an ii.

inside bar A bar with a high that is at or below the high of the prior bar and a low

that is at or above the low of the prior bar.

institution Also called the smart money, it can be a pension fund, hedge fund,

insurance company, bank, broker, large individual trader, or any other entity that

trades enough volume to impact themarket.Market movement is the cumulative effect

of many institutions placing trades, and a single institution alone usually cannot

move a major market for very long. Traditional institutions place trades based on

fundamentals, and they used to be the sole determinant of the market’s direction.

However, HFT firms now have a significant influence on the day’s movement since

their trading currently generates most of the day’s volume. HFT firms are a special

type of institutional firm and their trading is based on statistics and not fundamentals.

Traditional institutions determine the direction and target, but mathematicians

determine the path that the market takes to get there.

xviii LIST OF TERMS USED IN THIS BOOK

ioi Inside-outside-inside—three consecutive bars where the second bar is an outside

bar, and the third bar is an inside bar. It is often a breakout mode setup where

a trader looks to buy above the inside bar or sell below it.

ledge A bull ledge is a small trading range with a bottom created by two or more

bars with identical lows; a bear ledge is a small trading range with a top created by

two or more bars with identical highs.

leg A small trend that breaks a trend line of any size; the term is used only where

there are at least two legs on the chart. It is any smaller trend that is part of a

larger trend and it can be a pullback (a countertrend move), a swing in a trend or

in a sideways market, or a with-trend move in a trend that occurs between any two

pullbacks within the trend.

likely At least 60 percent certain.

long A person who buys a position in a market or the actual position itself.

lot The smallest position size that can be traded in a market. It is a share when

referring to stocks and a contract when referring to Eminis or other futures.

lower high A swing high that is lower than a previous swing high.

lower low A swing low that is lower than a previous swing low.

low 1, 2, 3, or 4 A low 1 is a bar with a low below the prior bar in a bear flag or

near the top of a trading range. If there is then a bar with a higher low (it can occur

one or several bars later), the next bar in this correction whose low is below the

prior bar’s low is a low 2. Third and fourth occurrences are a low 3 and 4. A low 3

is a wedge bear flag variant.

major trend line Any trend line that contains most of the price action on the

screen and is typically drawn using bars that are at least 10 bars apart.

major trend reversal A reversal from a bull to a bear trend or from a bear trend

to a bull trend. The setup must include a test of the old trend extreme after a break

of the trend line.

meltdown A sell-off in a bear spike or a tight bear channel without significant

pullbacks and that extends further than the fundamentals would dictate.

melt-up A rally in a bull spike or a tight bull channel without significant pullbacks

and that extends further than the fundamentals would dictate.

micro Any traditional pattern can form over one to about five bars and still be

valid, although easily overlooked. When it forms, it is a micro version of the pattern.

Every micro pattern is a traditional pattern on a smaller time frame chart, and every

traditional pattern is a micro pattern on a higher time frame chart.

micro channel A very tight channel where most of the bars have their highs and

lows touching the trend line and, often, also the trend channel line. It is the most

LIST OF TERMS USED IN THIS BOOK xix

extreme form of a tight channel, and it has no pullbacks or only one or two small

pullbacks.

micro double bottom Consecutive or nearly consecutive bars with lows that are

near the same price.

micro double top Consecutive or nearly consecutive bars with highs that are

near the same price.

micro measuring gap When the bar before and the bar after a strong trend bar

do not overlap, this is a sign of strength and often leads to a measured move. For

example, if there is a strong bull trend bar and the low of the bar after it is at or

above the high of the bar before it, the midpoint between that low and that high is

the micro measuring gap.

micro trend channel line A trend channel line drawn across the highs or lows

of three to five consecutive bars.

micro trend line breakout A trend line on any time frame that is drawn across

from two to about 10 bars where most of the bars touch or are close to the trend

line, and then one of the bars has a false breakout through the trend line. This false

breakout sets up a with-trend entry. If it fails within a bar or two, then there is

usually a countertrend trade.

money stop A stop based on a fixed dollar amount or number of points, like two

points in the Eminis or a dollar in a stock.

moving average The charts in this book use a 20-bar exponential moving average,

but any moving average can be useful.

micro double bottom Consecutive or nearly consecutive bars with lows that arenear the same price.微小双底:该形态由各棒低点都接近同样价格的至少两个连着的(或几乎连续)的棒烛组成。micro double top Consecutive or nearly consecutive bars with highs that arenear the same price.微小双底:至少两个连着的或几乎连着的(多个)棒若其棒高点皆接近同一价位就是该形态。micro measuring gap When the bar before and the bar after a strong trend bardo not overlap, this is a sign of strength and often leads to a measured move. Forexample, if there is a strong bull trend bar and the low of the bar after it is at orabove the high of the bar before it, the midpoint between that low and that high isthe micro measuring gap.微等距测量性缺口:离开一个强趋势棒的,并和该强棒没价格相叠的棒,而该棒可以出现在强棒之前也可以之后,这种带相离缺口的形是表征强度的,其后的行情是顺向移动且度量是等距测量性的micro trend channel line A trend channel line drawn across the highs or lowsof three to five consecutive bars.微小趋势通道线:过3到5个连续棒的高点或低点画条趋势通道线micro trend line breakout A trend line on any time frame that is drawn acrossfrom two to about 10 bars where most of the bars touch or are close to the trendline, and then one of the bars has a false breakout through the trend line. This falsebreakout sets up a with-trend entry. If it fails within a bar or two, then there isusually a countertrend trade.微小趋势线突破:任何时间周期框架的棒,在2个到10个棒的同端画直线并符合拟合接近各棒之端点的要求(线和端点不偏太多),这时这组棒中的一个开始假突破穿越该趋势线。因为假突破必会掉头,这样此假突破就是“就备”了一个顺趋势(不往假突破点走)的入场条件。假若上述情况却只持续了一个到两个棒就失败了,接着也就通常地变成一个逆趋势交易(走势)。money stop A stop based on a fixed dollar amount or number of points, like twopoints in the Eminis or a dollar in a stock.按钱量止损:如果按损一个固定的资金损失量来设止损就是“按钱量止损”,比如在电子迷你(SP500)指数盘用两个点,股票用一美元价差作止损量。moving average The charts in this book use a 20-bar exponential moving average,but any moving average can be useful.均线:本书的各图皆以20EMA(20指数移动平均线)为均线,但是实际上任何类型和周期的均线都有其用处。

moving average gap bar (gap bar) A bar that does not touch the moving average.

The space between the bar and the moving average is the gap. The first pullback

in a strong trend that results in a moving average gap bar is usually followed

by a test of the trend’s extreme. For example, when there is a strong bull trend and

there is a pullback that finally has a bar with a high below the moving average, this

is often a buy setup for a test of the high of the trend.

nesting Sometimes a pattern has a smaller version of a comparable pattern

“nested” within it. For example, it is common for the right shoulder of a head and

shoulders top to be either a small head and shoulders top or a double top.

news Useless information generated by the media for the sole purpose of selling

advertising and making money for the media company. It is unrelated to trading, is

impossible to evaluate, and should always be ignored.

oio Outside-inside-outside, an outside bar followed by an inside bar, followed by

an outside bar.

oo Outside-outside, an outside bar followed by a larger outside bar.

opening reversal A reversal in the first hour or so of the day.

xx LIST OF TERMS USED IN THIS BOOK

outside bar A bar with a high that is above or at the high of the prior bar and a

low that is below the low of the prior bar, or a bar with a low that is below or at the

low of the prior bar and a high that is above the high of the prior bar.

outside down bar An outside bar with a close below its open.

outside up bar An outside bar with a close above its open.

overshoot The market surpasses a prior price of significance like a swing point

or a trend line.

pause bar A bar that does not extend the trend. In a bull trend, a pause bar has a

high that is at or below the prior bar, or a small bar with a high that is only a tick or

so higher than the previous bar when the previous bar is a strong bull trend bar. It

is a type of pullback.

pip A tick in the foreign exchange (forex) market. However, some data vendors

provide quotes with an extra decimal place, which should be ignored.

pressing their longs In a bull trend, bulls add to their longs as in a bull spike

and as the market breaks out to a new high, because they expect another leg up to

about a measured move.

pressing their shorts In a bear trend, bears add to their shorts in a bear spike

and as the market breaks out to a new low, because they expect another leg down

to about a measured move.

price action Any change in price on any chart type or time frame.

韬客社区www.talkfx.co

37楼

本帖最后由 精工美元 于 2013-5-3 15:17 编辑

翻译也好 ,以后可以用中文解说,2 试= 二次尝试,SETUP 进场“就备”模式;

交易理念:单是意节的函数

四个图:

NZD4-30.jpg

NZD4-30.jpg NZD 5M 4-30.jpg

NZD 5M 4-30.jpg 5-1GBPB-.jpg

5-1GBPB-.jpg 30AUD 5M APRI.jpg

30AUD 5M APRI.jpg

NZD4-30.jpg

NZD4-30.jpg NZD 5M 4-30.jpg

NZD 5M 4-30.jpg 5-1GBPB-.jpg

5-1GBPB-.jpg 30AUD 5M APRI.jpg

30AUD 5M APRI.jpg韬客社区www.talkfx.co

发表于:2013-05-08 09:22只看该作者

38楼

对于price action 不了解的人,直接买本AL Brooks的书看看就好 (reading price charts bar by bar),当然,英语得过关。至于支撑,阻力位,买本<期货市场技术分析>看看,该有的都有了。剩下的就是心态,纪律性。每天市场那么多行情,那么多信号,挑几个最适合自己的做就好。想要每波行情都吃,到最后就是越做越差

韬客社区www.talkfx.co

39楼

韬客社区www.talkfx.co

JXGZHEN-5-10-.jpg

JXGZHEN-5-10-.jpg 5-10-GBP-.jpg

5-10-GBP-.jpg